Risk Strategy

World economy facing "Japanese-style" growth trap

World corporate risk reaches peak levels

2016 FM Global Resilience Index

Lower Oil Prices and Threat of Terrorism Impacting Global Supply Chain Resilience

Greed eats brains

FTX as Enron anno 2022?

No sooner had new CEO John J. Ray III taken over at the insolvent crypto exchange FTX than he described the situation as a "unprecedented situation", with a total failure of corporate governance. This…

Redefining business success in a changing world

CEO's concerns about geopolitics

Business interruption on the rise

Modern supply chains vulnerable to disruption

Interview with Emeritus Professor Dr. Günther Schmid

The liberal rule-based world order was a myth

The invasion of Ukraine by Russian forces began on 24 February 2022. The Russian war against Ukraine has seen post Cold War hopes for a peaceful world order disappear almost overnight. But this war of…

Continual data management strategy

Lost in the Data Jungle

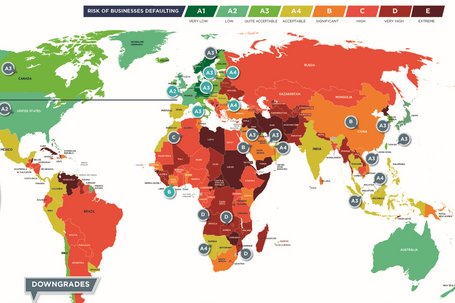

Political Risk Map 2015

Growing political risk in the year ahead and beyond

Environment, Social and (Corporate) Governance

Simulation methods for quantifying ESG risks

ESG risks and opportunities are highly relevant as causes and drivers for positive or negative scenarios with a significant impact on a company's reputation or intangible assets. The following article…