Bank Regulation and Supervision

Higher resilience against unexpected market shifts

Enhancing Bank Stress Tests with AI and Advanced Analytics

Interdisciplinary study

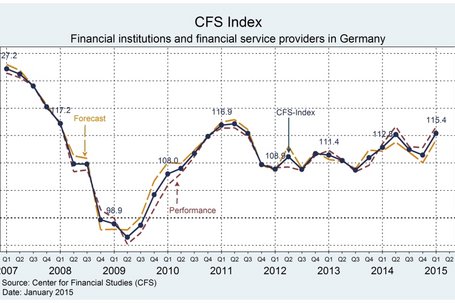

A Positive Assessment for Reforms of Financial Market Regulation

Defining Trends and Ways to Prepare

Risk Management Forecast for 2024

2023 undeniably etched its place in financial services history, a year marked by accelerating change and a precarious financial climate. It brought calamity in the form of largely unforeseen bank…

Redefining business success in a changing world

CEO's concerns about geopolitics

Financial Stability Board Publication

Total Loss-Absorbing Capacity standard

Greed eats brains

FTX as Enron anno 2022?

No sooner had new CEO John J. Ray III taken over at the insolvent crypto exchange FTX than he described the situation as a "unprecedented situation", with a total failure of corporate governance. This…