![Etymologie des Risikobegriffs [Bildquelle: © Adobe Stock] Etymologie des Risikobegriffs [Bildquelle: © Adobe Stock]](/fileadmin/user_upload/Headerbilder/Headerbild_Etymologie.jpg)

The origins of modern risk and probability theory are very closely linked to games of chance, which are known to have existed and been popular for millennia [see Romeike/Hager 2009 p. 21]. Since the beginning of time, people have played games of chance without knowing anything about theoretical systems for distribution of opportunities or being influenced by the theory of modern risk management and probability calculations. In the past, and even today, games of chance are directly linked to "fate". In a way, a game of chance is the epitome of consciously taking a risk. For example, in the three thousand year old Hindu work the Mahabharata we can read about a fanatical dice player who bet himself on a game when he had already lost everything he owned [see Romeike/Müller-Reichart 2008, p. 25]. Mahabharata is the best known Indian epic. It is thought to have first been written down between 400 BC and 400 AD, but is based on older traditions.

The oldest known games of chance used what was known as an "astragalus", the forerunner of today's six-sided die. An astragalus was a square bone, which was originally made from the hard ankle bones of sheep or goats (see figure below).

Archaeological discoveries have confirmed that dice games using astragali were popular with the Ancient Egyptians. Because of their square edged shape, they had four different possible rest positions, with different probabilities for the results. Modern style dice were also used alongside them. Ancient writers were already propounding theories about their invention, including Pliny the Elder (Roman scholar, * around 23 in Novum Comum; † 24th August 79 in Stabiae), who attributed it to Palamedes, a hero of Greek mythology, during the Trojan War. Meanwhile the Ancient Greek historian, geographer and ethnographer Herodotus (* 490/480 BC, † around 425 BC) attributed dice games to the Lydian people [see Ineichen 1996, p. 41 onwards].

However, it is firmly believed that they were adopted from the Orient. As well as the six-sided dice we know today, examples of 12, 18, 19, 20 and 24-sided dice have also been discovered. There were a wide range of traditional materials, including clay, metal, ivory, crystal, bone and glass. There were also dice with letters and words instead of numbers, and even examples with eyes, thought to have been used for fortune-telling or complex dice games.

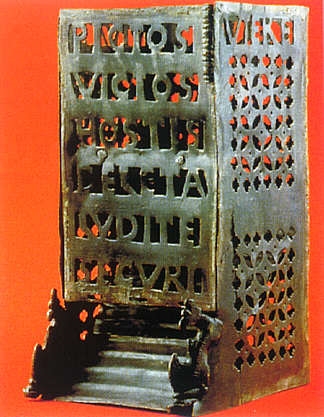

According to the writings of the Roman senator and historian Publius (or Gaius) Cornelius Tacitus (* around 55, † after 116) the Germanic peoples in particular would frivolously play for their house or farm, and even for their own freedom [see Romeike/Hager 2009, p. 21]. Nevertheless, dice games were widespread in the Roman age, despite repeated bans on them. This appears to have been due to cheating. Ancient dice cups and dice towers have been discovered that are intended to prevent soldiers of fortune from ripping off their opponents. Dice are tossed into dice towers from above and roll down through the inside of the tower over several levels to the outlet. The figure below shows a bronze turricula (Latin for dice tower) found in a Roman villa near Froitzheim (Düren district) in 1984.

The die is cast

Even the great Roman statesman, general and writer Gaius Julius Caesar (* 13th July 100 BC in Rome; † 15th March 44 BC in Rome) loved games of chance and is well known to have said the words "Alea iacta est" (The die is cast) on 10th January 49 BC when he crossed the River Rubicon on the border of Italy to start a civil war. This form of the phrase was first cited by the historian Sueton: On 10th January 49 BC, Julius Caesar and his army arrived at the Rubicon, the river marking the border between the provinces of Cisalpine Gaul and Italy, which no Roman general was permitted to cross with his troops. While he stood there indecisively, a herdsman snatched a trumpet from one of the soldiers, crossed the river and sounded the alarm. Then Caesar said: "Eatur quo deorum ostenta et inimicorum iniquitas vocat. Iacta alea est.".

As today, the result of games of chance back then was primarily random and did not depend on the skill or abilities of the players (apart from cheats using marked dice). The different games of chance varied in terms of the probability of winning and the ratio of the winnings paid out to the stakes put in. In general, until the present day the rules of the game and the payouts are set up in such a way that a player in a game of chance will lose money in the long term, i.e. by playing frequently.

In the Middle Ages, this phenomenon was accepted as being "given by God". The Medieval world view was of a closed and hierarchically structured Cosmic order (ordo) – including all exceptions, restrictions and boundary phenomena. While God determines the course of things at the top of the pyramid of being, people – as the "summit of creation" – are the link between the spiritual and material worlds. Like people, nature and events are also controlled by God. The individual is just a part of this holy order, and is assigned a quite specific and fixed place in the "universitas". People did not really see themselves as individuals, but as members of a community.

Risks lurk in the future

Until the end of the Medieval period, the typical response to risk could therefore be seen as tending to be rather passive or hesitant. People were expecting the coming of God's kingdom. Understanding of the world at that time put limits on individual action – for example active management of opportunities and risks.

But even the natural religious and mythical sacrifices and rituals belonged in the sphere of (magical and subjective) risk minimisation, which primarily involved excluding unforeseen and threatening events – or future risk – from one's own systemic thinking.

Events that have not yet occurred, strokes of fate and risks lurk maliciously in the corridors of a future that denies us the chance to "look around the corner" [see Bardmann, 1996]. In the Roman Empire, with increasing legal codification of societal relationships, intended to remove uncertainty, and with growing secularisation of economic activities, this led to a religious configuration that "must be seen as the last bastion of mythical thinking and as probably the most important counter figure to the Christian faith in the omnipotence of one true god: the incredibly popular cult Fortuna, the goddess of providential but incalculable chance" [see Nerlich, 1998, p. 81].

The future turns into risk

Fortuna, the goddess of chance, daring action and thus taking risks, was the last of the ancient gods to have survived and been worshipped, which allows us to at least conclude that in the late Roman empire, experimental responses to the world had become such a fundamental tendency in everyday society that religious fear could hardly have been of radical importance.

By contrast, modern society does not approach the future as an eternity, but visualises it in predictions for the coming present: The future turns into risk. The overriding focus on religious faith is eliminated. This is compensated by rational action strategies, which necessarily produce risk.

Modern response to risk is characterised by being rational and active ("risk managers or board members manage risks preventively and actively"). The value and standing of a way of life is not determined by the grace of God or the undeserved nobility of God's mercy, but by individual capability. The key is to take on challenges, address risks "proactively" and preventively and take advantage of opportunities. The fact that any situation can be viewed in terms of its possible changeability means that every decision involves risk [see Beck, 1991].

From maritime trading to the term risk

Based on a etymological analysis, the (European) term "risk" can be traced back to the three words fear, adventure and risk [see Keller 2004, and Romeike/Hager 2009, p. 31]. The Old German terms for fear imply distress and adversity experienced both physically and psychologically. In terms of their meanings, these words are the roots of the terminology used for commercial risk. As early as the Late Medieval period, the term adventure (aventiure, Abenteuer) referred to pecuniary ventures and summarises an ideology that absolutises adventure as a strategy for individual consolidation of self-worth. The loan word used in Middle High German is employed in the context of a courtly and chivalric world for the search for hazardous situations and for combative confrontations with an uncertain outcome. In terms of the risky undertakings of crusaders, euphemisms for the term "crusade" were common. At that time, people used euphemisms such as journey (expeditio, iter) or pilgrimage (peregrinatio). The modern term risk (Italian rischio, Spanish riesgo, French risque, German Risiko) can be traced back to the Early Italian risco (meaning "cliff") and to the Greek "ριζα" ("rhíza") meaning "root". Cliff, Klippe, récif are the word origins of the Spanish riesgo, the French risque and the Italian risico, risco, rischio.

The German word "Risiko" is borrowed from these Italian words. Both a "cliff" to be sailed around and a "root" protruding from the ground represent a risk. Etymologists dispute the links suggested to the Arabic word "risq" meaning "god-given, fate, subsistence". Therefore, risk can generally be defined as the hazard associated with an enterprise, undertaking or similar action.

The current (modern) term "risk" appeared for the first time in the Northern Italian city states in the 14th Century. Burgeoning maritime trade led to the development of maritime insurance [see Romeike/Müller-Reichart 2008]. Risk refers to the danger that existed then, as it does today, that a ship could sink, perhaps because it shatters on a cliff or is captured by pirates. Since the 15th Century, the concept of risk became increasingly established as a commercial definition in other European languages. In Germany, the first documented uses of the Italian or Catalan words come from shortly before 1500, and shortly afterwards we can find the German word for risk, "Risiko", in conjunction with the commonly used expression "Abenteuer" or "Auventura" (adventure) in an accounting ledger from 1518: There is a note that trade involves "adventure and risk" [see Keller 2004, p. 62].

Further literature:

- Bardmann, T. M. (1996) Foreword in: Kleinfellfonder, B.: Der Risikodiskurs, Zur gesellschaftlichen Inszenierung von Risiko [Risk Discourse, On the Social Enactment of Risk], Opladen 1996.

- Beck, U. (1991): Risikogesellschaft. Auf dem Weg in eine andere Moderne [Risk Society. On the Way to a Different Modernity], Frankfurt a.M. 1986 and BECK, U.: Politik in der Risikogesellschaft [Politics in the Risk Society], Frankfurt a.M. 1991.

- Bernstein, P. L. (1996): Against the Gods: Remarkable Story of Risk, New York 1996.

- Bernstein, P. L. (1997): Wider die Götter – Die Geschichte von Risiko und Riskmanagement von der Antike bis heute [Against the Gods - The History of Risk and Risk Management from Antiquity to the Present Day], Munich 1997.

- Erben, R. F./Romeike, F. (2003): Allein auf stürmischer See – Risiko-Management für Einsteiger [Alone on a Stormy Sea - Risk Management for Beginners], Weinheim 2003.

- Ineichen, R. (1996): Würfel und Wahrscheinlichkeit – Stochastisches Denken in der Antike [Dice and Probability - Stochastic Thinking in Antiquity], Heidelberg/Berlin/Oxford 1996.

- Ineichen, R. (2002): Würfel, Zufall und Wahrscheinlichkeit [Dice, Chance and Probability], in: Magdeburger Wissenschaftsjournal 2 (2002).

- Keller, E. (2004): Auf sein Auventura und Risigo handeln. Zur Sprach- und Kulturgeschichte des Risikobegriffs [Subject to Adventure and Risk. The Linguistic and Cultural History of the Concept of Risk], in: RISKNEWS, Issue 1/2004, p. 60-65.

- Nerlich, M (1998): Zur abenteuerlichen Moderne oder von Risiko und westlicher Zivilisation [The Adventurous Modern World, or Of Risk and Western Civilisation], in: Risiko. Wieviel Risiko braucht die Gesellschaft? [Risk. How Much Risk Does Society Need?], Berlin 1998.

- Pechtl, A. (2003): Ein Rückblick: Risiko-Management von der Antike bis heute [A Review: Risk Management from Antiquity to the Present Day], in: Romeike, F./Finke, R. (Editors): Erfolgsfaktor Risiko-Management: Chance für Industrie und Handel, Lessons learned, Methoden, Checklisten und Implementierung [Risk Management as a Success Factor: Opportunities for Industry and Commerce, Lessons Learned, Methods, Checklists and Implementation], Wiesbaden 2003, p. 15 onwards.

- Romeike, F./Müller-Reichart, M. (2008): Risikomanagement in Versicherungsunternehmen [Risk Management in Insurance Companies], Weinheim 2008.

- Romeike, F./Hager, P. (2009): Erfolgsfaktor Risk Management 2.0 – Methoden, Beispiele, Checklisten: Praxishandbuch für Industrie und Handel [Risk Management as a Success Factor 2.0 - Methods, Examples, Checklists: Practical Handbook for Industry and Commerce], 2nd edition, Wiesbaden 2009.