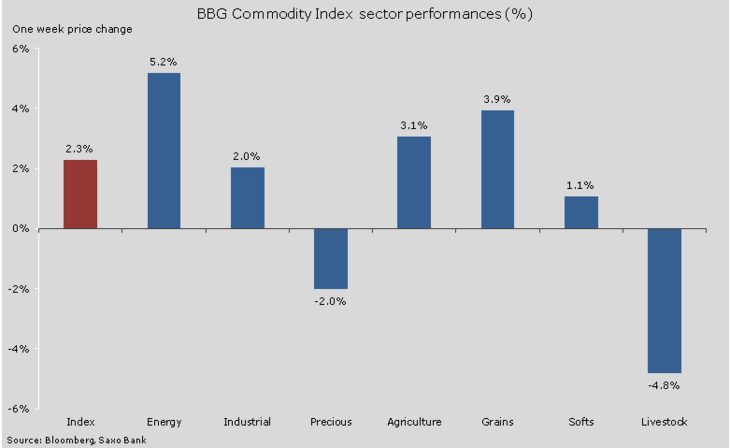

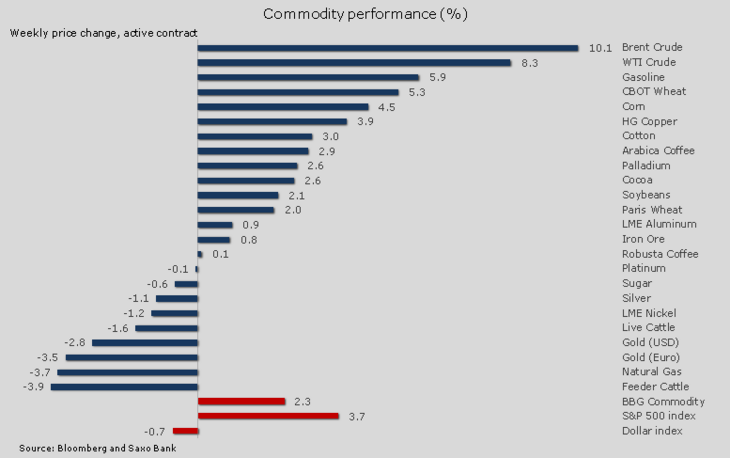

Commodities made a strong comeback during the past week with the Bloomberg Commodity index returning 2.3%, the best weekly result in 18 months. Gains were seen across most sectors apart from precious metals and especially livestock.

Overextended short positions in euros triggered a mid-week recovery which lend a hand to the sector. But as the US blasted out another strong monthly job report it moved lower again.

The energy sector continues to attract most of the attention and the 5.2% jump would have been even higher if it had not been for continued weakness in natural gas.

Brent crude was on track to record its best weekly performance since October 2009 and the best two-week run in 17 years.

The rally this week, however, was not linear with both crude oils cumulatively travelling more than $22/barrel within a $10/b range. As a result of these often violent moves, volatility spiked to a six year high at 63%.

Precious metals had a quiet week until Friday's job report. Until then, it had been stuck between two chairs as it found support from a weaker dollar against reduced event risk, a hawkish Federal Open Market Committee and the risk of long liquidation following strong buying during January.

Industrial metals were initially hit by the first contraction in China's manufacturing PMI in more than two years but later took comfort from a surprise cut to the reserve requirements. The market took this as a sign that The People's Bank of China may be moving towards more aggressive monetary easing.

As a result, copper snapped its longest weekly losing streak since 2008.

The grain sector received a boost from increased export demand after prices had reached levels that attracted renewed interest from foreign buyers. Wheat for March delivery found support at $5/bushel from where it rallied strongly as buyers from Japan, Egypt and Saudi Arabia came calling.

The Russian winter wheat crop is in poor condition, according to reports, and that also helped an oversupplied market to refocus.

Phenomenal week for crude

During the past week, we have seen some dramatic movements in global oil benchmarks WTI and Brent crude.

As the Bloomberg chart below shows we had three major moves in just one week, all of which were bigger than 10%. As a result of this raised tug of war between negative fundamentals and a surge in investor demand, volatility has risen to levels not seen since April 2009 – which back then led to a sustained rally following the collapse in the aftermath of the economic and financial crisis.

Source: Bloomberg

The bullish drivers have been numerous, with the ones receiving most attention as follows:

- a sharp reduction in US rig count to a three-year low

- major oil companies reducing future investment plans

- a US refinery strike which gave products a lift

- shorts covering after short positions doubled in one month

- reduced supplies from Libya as fighting intensifies

The current bullish momentum has the potential of extending the rally in WTI to $58/b and Brent to $63.70/b, levels that coincide with the consolidation area seen back in December.

Demand for energy ETFs remain strong

Investors betting on a rebound after seeing prices fall by over 50% since last June have reacted strongly to the string of supportive news and the result of this has been a big pick-up in interest for energy ETFs.

Since the beginning of the year, more than $2.7 billion has been put to work in the sector and most popular have been the ETFs tracking the performance of WTI crude oil, such as USO:arcx, UCO:arxc and OIL:arcx.

US inventory rise creating headwinds

US oil companies maintain production above 9 million barrels/day and this resilience, amid a sharp drop in rig count, continues to obstruct a proper recovery at this stage.

Crude oil inventories at Cushing, the delivery hub for WTI crude oil, rose by 2.5 million barrels last week and have more than doubled since October.

With prospects for the current refinery strike slowing demand for crude, this level may rise even further over the coming weeks.

As a result of this and ongoing fighting in Libya, which has slowed exports, we also have the explanation as to why Brent crude oil's premium over WTI crude is back on the rise again.

From parity a month ago the premium has risen above $6/b and could continue until we see a slowdown in US production.

Market share battle

Saudi Arabia's state oil company, Saudi Aramco, released its official selling prices for March. In order to support the ongoing battle for market share, it cut the selling price to Asian customers to a discount of $2.30/b below the Platts Oman/Dubai benchmark.

According to Bloomberg data, this is the lowest price in at least 14 years and is down from a premium of $1.75/b last year. This is a clear sign that the world's largest exporter of crude oil is fully committed to defending its market share.

It is also a clear sign that the oversupply in the global market is still an issue. Reduced demand for imports from US refineries have led to an increased amount of cargoes from Russia, West Africa and Latin America looking for a new destination and with Asia having the biggest growth potential, this is where most of the major oil producers have now turned their focus.

Permanent recovery still just a speck on the horizon

A V-shaped recovery in oil prices like the one we witnessed back in April 2009 still seems very unlikely given the current oversupply and outlook for this to get even worse before improving.

The most likely outcome of this current elevated price volatility therefore point towards a market that will eventually settle into a major range close to current levels for a prolonged period of time.

That is at least so until we either see supply, especially from the US being reduced, or we see a pick-up in global growth and demand. Both of these events are not expected to materialise until the second half of 2015 the earliest.

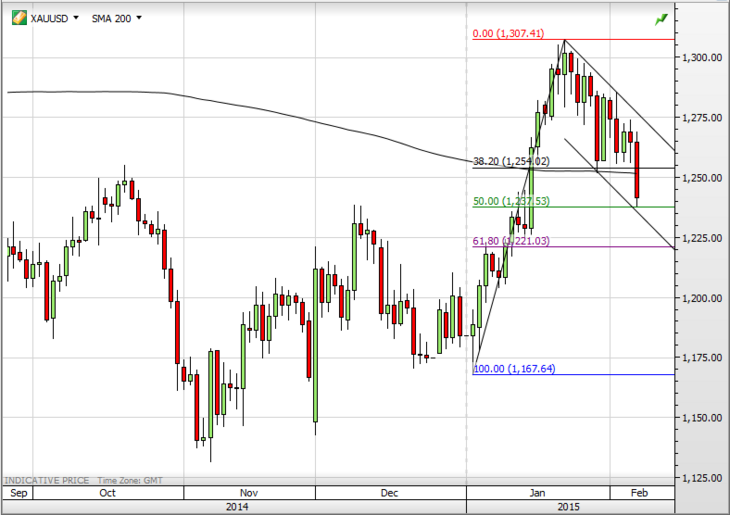

Gold range-bound until US job report sent it down

Gold settled into a range between key support at $1,250/0z and resistance at $1,286/oz following a very impressive performance in January. That however only lasted until Friday when a stronger-than-expected US job report sent the dollar higher and precious metals lower.

The rally during January attracted a great deal of investment interest both from investors using exchange-traded products but also from hedge funds.

The calm is not being reflected in the options market where at-the-money volatility is trading near the higher-end of its recent range while the cost of protection for both the up and downside remain elevated.

There has been a sizable build up in long positions since the Swiss National Bank's decision to remove the Swiss franc's peg to the euro and most of this buying both from hedge funds in futures and from ETF investors has been done at prices above $1,250/oz.

The Federal Open Market Committee is currently much more bullish in its expectations for rate hikes compared with the market. On that basis incoming data will be watched very closely in order to determine who is right.

The break below support on Friday has now left the door open to a deeper correction, initially to $1238 followed by $1221.50 ahead of the key psychological $1200 level.

Author:

Ole Hansen, Head of Commodity Strategy, Saxo Bank. Ole Sloth Hansen is a specialist in all traded Futures, with over 20 years’ experience both on the buy and sell side. Hansen joined Saxo Bank in 2008 and is today Head of Commodity Strategy focusing on a diversified range of products from fixed income to commodities. He previously worked for 15 years in London, most recently for a multi-asset Futures and Forex Hedge fund, where he was in charge of the trade execution team. He is available for comments on most commodities, especially energies and precious metals.