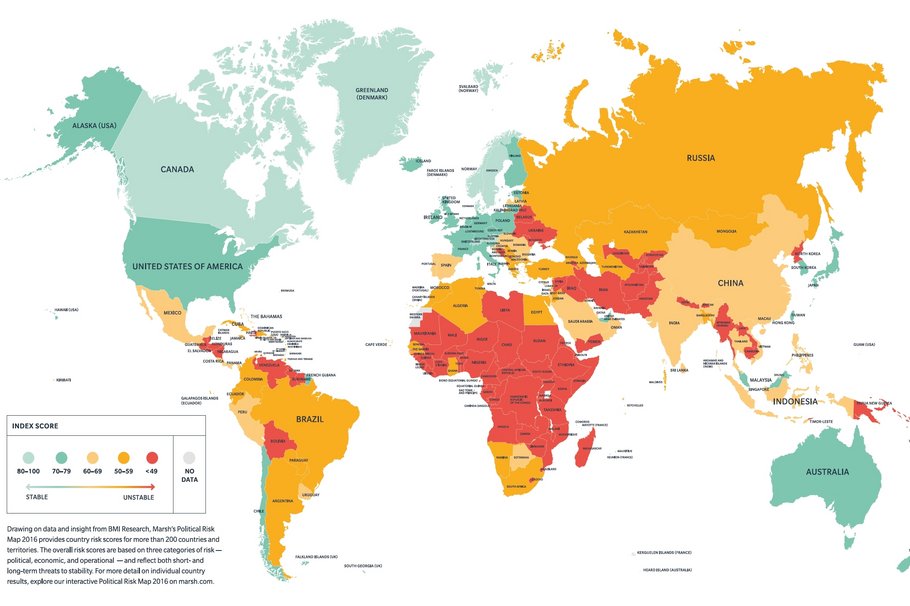

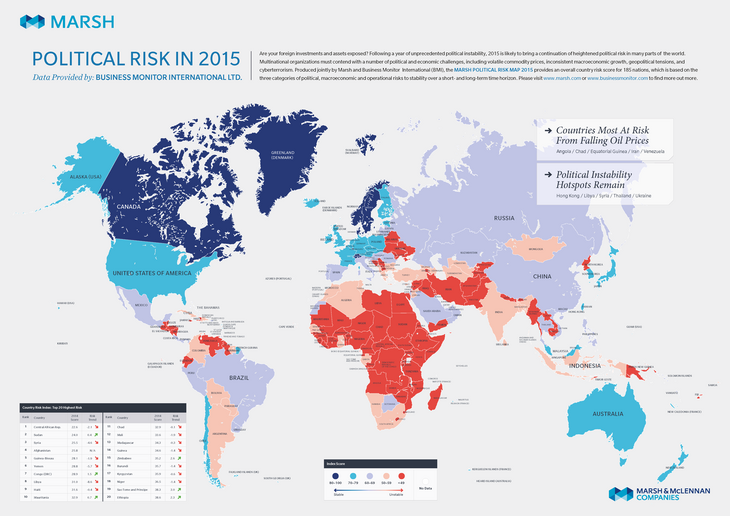

Geopolitical tensions, falling commodity prices, separatist movements, and more are shaping today’s political risk landscape. There is a clear divide between healthy emerging markets and those that represent poor investments for foreign investors, according to the MARSH POLITICAL RISK MAP 2015. Drawing on data from Business Monitor International (BMI), a leading source of independent political and credit risk analysis, the map includes overall risk scores for 185 countries based on three categories: political risk, macroeconomic risk, and operational risk.

The following are key findings from BMI and Marsh regarding the major political risks that investors and multinational businesses will face in 2015 and beyond.

Falling oil prices

In the second half of 2014, prices for Brent crude oil fell sharply, from US $110 per barrel in June to less than US $70 per barrel in December. Lower prices will likely benefit many oil-importing nations, reducing inflationary pressures and, by extension, political risks. However, a prolonged period of lower oil prices will likely have a negative impact on some net oil exporters. These countries can be divided into three groups, according to BMI:

- Severe risk: Angola, Chad, Equatorial Guinea, Iran, and Venezuela.

- High risk: Congo-Brazzaville, Gabon, Iraq, Nigeria, and Sudan.

- Moderate risk: Colombia, Ecuador, Mexico, and Russia.

Venezuela, where oil accounts for more than 95% of exports and more than half of government revenues, is particularly vulnerable.

"After years of currency devaluation, Venezuela’s underlying political risk profile is already troubling," said Yoel Sano, BMI’s head of Global Political and Security Risk. "With parliamentary elections upcoming, the drop in oil prices could be the final straw for the Maduro government."

BMI’s data suggests that Iran is similarly vulnerable as a deteriorating economy could erode support for the moderate government and accelerate currency devaluation, leading to higher inflation. A threat to Iran’s political stability could have a negative effect on ongoing negotiations about the future of the country’s nuclear program and related economic sanctions currently imposed against Iran.

Divergence of emerging economies

Over the last several years, it has become clear that the term "emerging markets" can no longer be used as a single label for all developing economies. There is now a clear divergence between those countries that represent strong investment opportunities and those that do not. Three countries with good prospects for economic reforms are China, India, and Indonesia, according to BMI.

"In China, President Xi Jinping has taken action against corruption, and is aggressively consolidating his political position," Mr. Sano said. "There is reason to be cautiously optimistic in his ability to enact some needed reforms, such as rebalancing the economy to be driven more by consumption than fixed investment and exports, liberalizing the financial system, and reducing the role of the state."

India and Indonesia both have new leaders who are backed by strong electoral mandates and are more inclined to enact reform than their predecessors. According to BMI, India appears slightly further ahead in this regard; new Prime Minister Narendra Modi seems more ideologically committed to reform, and has strong backing in India’s parliament. BMI believes that Mexico is also showing some positive signs of reform, particularly regarding liberalization of the energy industry, although midterm elections in 2015 could stall progress. And Argentina has a chance to move away from some of its interventionist economic policies of the last several years, depending on the outcome of elections scheduled there for October 2015.

Conversely, BMI is pessimistic about potential economic reforms in Russia. This is due, in part, to economic sanctions imposed by the US and other Western governments following Russia’s annexation of Crimea and intervention in Eastern Ukraine. It is clear that the Putin government is prioritizing geopolitical strength over liberalization and openness of the economy. There is also reason to be skeptical about reform prospects in Brazil and South Africa, where incumbent leaders appear less committed to economic reforms.

BMI believes that tightening of US monetary policy and the end of the Federal Reserve’s longstanding policy of “quantitative easing” could further highlight rifts between stronger and weaker emerging markets.

Political violence extending beyond media

While political violence has been a concern in the Middle East and North Africa in recent years, BMI also highlighted it as a risk elsewhere, including in:

- Ukraine, as the pro-Russia separatist movement continues.

- Thailand, which saw a military coup — the latest turn in a long-term trend of protests and toppled governments there.

- Hong Kong, where recent protests have been somewhat unexpected, given that region’s reputation for stability over many years. Although the protests have so far been peaceful, their fundamental drivers — primarily, Beijing’s involvement in vetting candidates for the 2017 election of a new chief executive — have not yet been addressed. This could signal continued unrest ahead of the election.

Other countries could be susceptible to mass unrest and violence in 2015, according to BMI, particularly where people are growing frustrated by economic mismanagement and/or decades of a single leader holding power.

It has not been common for longstanding African governments to be toppled by mass protests, but that’s exactly what happened recently in Burkina Faso when President Compaore tried to extend his 27-year rule. These events may give pause to similarly situated African leaders, including in Benin, Cameroon, and the Democratic Republic of Congo.

BMI believes that similar dynamics may be at play in Central Asia, where opaque presidential succession processes could lead to power struggles; and falling oil prices could contribute to unrest in Venezuela if its economy destabilizes. There’s also concern about upcoming elections in Sri Lanka triggering violence in that country.

Autonomous and Separatist movements

Around the world, movements are being driven by political, regional, and/or ethnic groups seeking independence, more power, or autonomy from existing governments. In most cases, it is unlikely that these movements will lead to new states in the near term. But the mere existence of such groups and associated political uncertainty — including the potential for violence in some cases — can have a significant effect on foreign investment. This is not an issue solely for developing economies, as evidenced by Scotland’s September 2014 referendum on independence.

Scotland’s referendum could serve as a source of inspiration for activists in other countries, according to BMI. That vote was watched closely by leaders of separatist movements in Spain (Catalonia), Bosnia and Herzegovina, and many other European, African, and Asian countries. These groups may now be thinking: If Scotland can have a referendum on independence, why can’t we?

Greater global conflict

The perception that the US is unwilling to enter into a major armed conflict or take a strong stance in international crises was likely a factor in Russia’s annexation of Crimea and China’s assertion of territorial claims in the East China Sea and South China Sea, according to BMI.

Although this perception was somewhat tempered by strong economic sanctions imposed against Russia by the US and EU, it is still contributing to global instability and heightened geopolitical tensions. This is occurring at a time when many emerging countries are seeking to gain more military and political influence.

"There are now a greater number of powerful countries acting on the world stage than has been the case over the past 25 years," Mr. Sano said. "As they expand their perceived spheres of influence, there is a greater likelihood that their interests will cause tensions. And if these countries are emboldened by the perceived weakness of the United States, that could lead to more conflict."

Social media

Beginning with the Arab Spring revolutions of 2011, social media has been a vital tool for dissidents in many parts of the world to accelerate change by facilitating the organization of protests and spreading awareness of political movements. More recently, social media has played a central role in the Russia-Ukraine conflict, contributing to a broader propaganda war in which several parties — including the Russian and Ukrainian governments — have sought to dictate the public narrative about who is responsible for the crisis. In 2014, social media has also been used in powerful and graphic form to increase awareness for previously obscure organizations such as the Islamic State terrorist group.

China, Iran, Turkey, and other countries have already taken steps to restrict access to some social media networks — or the internet as a whole — and additional attempts at censorship are possible in 2015. Authoritarian governments may also seek to use social networks to their advantage, as another means of communication beyond state-owned media.

State-sponsored cyber-attacks

Businesses and governments have fallen victim to a number of cyber-attacks and disruptions over the last several years. Some governments have been suspected of executing such attacks, but it is difficult to definitively attribute a cyber-attack to a government.

Generally speaking, the bigger cyber threats for businesses and governments today continue to be organized criminals and other private actors. It remains to be seen whether "cyberwarfare" emerges as a preferred tactic by governments engaged in conflicts with other countries. However, to date, there has not been a large-scale disruption of a country’s infrastructure — for example, a power grid of a major urban area or financial networks — as a result of a confirmed attack by another government.

Will 2017 be a year of Change?

Although multinational businesses should not lose focus on the year ahead, they should also be considering long-term risks. Many of the trends discussed in this document may affect a number of international elections scheduled for 2017. In addition to a new US president taking office in January and a possible referendum on EU membership in the United Kingdom, 2017 will see general elections in France and Germany, the outcomes of which will be critical for the future of the Eurozone. Hong Kong’s chief executive election and China’s Communist Party congress in 2017 will raise political risks in Greater China. Elsewhere, presidential elections in Iran and South Korea will be crucial in shaping the geopolitical landscape in the Gulf and in Northeast Asia.

Managing political risk

The events of the last 12 months demonstrate how quickly political and economic concerns can develop into large-scale crises, including in historically stable countries, and how long-term political dynamics can shift almost overnight. And amid falling oil prices, developing political unrest and violence, and growing tensions, even the most trusted investor and trading relationships could be tested in 2015 and beyond.

"For risk managers, the message is simple: Be prepared for anything, including in countries previously considered above reproach," said Evan Freely, Marsh’s Global Credit & Political Risk Practice Leader. "A broad, multi-country and multi-hazard approach to managing political risks remains the most practical and effective political and credit risk strategy for multinationals."

Multi-country political risk insurance policies can provide blanket regional or global coverage, often with more favorable terms and conditions than are available via single-country policies. These policies can be customized to provide coverage for a number of risks, including expropriation, political violence, currency inconvertibility, non-payment, and contract frustration. In addition to purchasing insurance, businesses should review their credit risks and credit-control policies and procedures, and evaluate both the short- and long-term impact of potential political risk events in various countries on their own operations and on those of their customers and suppliers. Organizations should review supply chain resiliency and business interruption plans and procedures before a crisis develops to help ensure that they have effective procedures in place to communicate with customers and suppliers when needed. Finally, businesses must consider the potential impact of political risk events on their people. In a crisis, multinational companies should have well conceived and tested procedures in place to communicate with and ensure the safety of their employees. And because credit and political risk insurance policies only cover assets and contracts, businesses should work with their risk advisors to ensure that they have other relevant forms of insurance coverage in place to protect their people, including foreign voluntary workers’ compensation and other casualty policies.

Download Political Risk Map 2015

[Source: MARSH RISK MANAGEMENT RESEARCH: Marsh Policial Risk Map 2015]