Topics-Archive

World economy facing "Japanese-style" growth trap

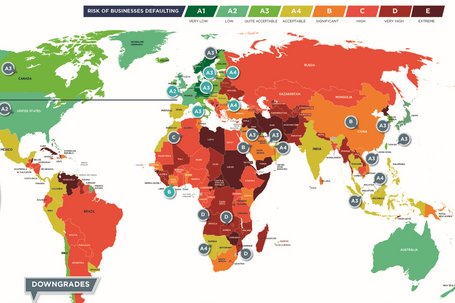

World corporate risk reaches peak levels

2016 FM Global Resilience Index

Lower Oil Prices and Threat of Terrorism Impacting Global Supply Chain Resilience

Metals surge despite flat macro outlook – oil…

Risk Analysis Commodity markets

Environment, Social and (Corporate) Governance

Simulation methods for quantifying ESG risks

ESG risks and opportunities are highly relevant as causes and drivers for positive or negative scenarios with a significant impact on a company's reputation or intangible assets. The following article…

Redefining business success in a changing world

CEO's concerns about geopolitics

Business interruption on the rise

Modern supply chains vulnerable to disruption

Non-Financial Risk Management

The painful financial side of NFR

The past as well as the present are full of examples of risk blindness, risk ignorance and downright stupidity. For instance, "The Reactor Safety Study" (Rasmussen, 1975) shows a prime case of…

Financial Stability Board Publication

Total Loss-Absorbing Capacity standard

Market and risk analysis

Stimulus and rate cuts a much needed lifeline for commodities

Genuine risk culture is a culture of trust, learning and responsibility

Learning from high reliability organisations

Even the best system for risk and opportunity management will be ineffective if it is not genuinely put into practice by all employees in the company on a daily basis. To prevent management of…