Unprecedented low interest rates, booming asset prices and the ever increasing challenge to remain profitable have led financial institutions in many parts of the world, and in Canada in particular, to take on more direct and indirect exposure to the real estate market.

In consequence, the same effects lead to an expansion of real estate risks in lending institutions which deserve heightened attention and proper management. With many banks competing in a tight market for the same clients, the risk appetite was often adjusted to market conditions, especially in terms of profit expectations, and has thus been growing. A conscious and well-structured analysis and decision-making process was, at best, implemented on a single real estate object level.

While these risks should be given special attention, lenders more often are even lacking a solid and structured data foundation on property object and type-of-use level, preventing them to perform an adequate valuation, let alone a more profound analysis of their real estate portfolio on risk-driver level.

We will concentrate on the expected rental price (and a reasonable segmentation by tenant) as the most prominent example of such an influential risk factor in the real estate market. A standard credit risk model (like Credit Metrics™) can be adapted to integrate rental prices as a risk driver. This is being implemented using a common property valuation method that depends on its rental price. In addition, the rental price in turn is linked to several background factors in order to enable a portfolio analysis and to propagate a systemic stress adequately, taking into account the correlation between default rates and collateral values.

The article concludes with thoughts on how a phased assessment and implementation approach should be tailored in the institution in order to proactively engage in real estate risk management.

The real estate market and economic conditions in canada

The real estate economy in Canada is very dynamic and sends out ambivalent signals, but is also subject to a number of interesting opportunities and challenges that should be under close scrutiny by any prudent risk manager.

On the one hand, as the Bank of Canada determined in its November 2017 Financial System Review [Bank of Canada 2017, p. 9], imbalances in the Canadian housing market are one of three key vulnerabilities in the Canadian financial system, which relates to at least an elevated level of household indebtedness. The Toronto and Vancouver regions remain in strong demand with a 10-15 % YOY house price growth, but also show pronounced signs of a bubble and speculative behaviour. Various measures and policies have been introduced by national and provincial authorities and regulators to cool off the market and keep indebtedness sustainable, e.g. with tightened mortgage underwriting rules, but the desired effect on markets is -as of yet- uncertain. With interest rates on the rise, this may push distressed indebted households into more unregulated segments of the market.

Indeed, a simple "Google Trends" analysis for March 2018 reveals quite vividly how much interest the topic "real estate bubble" draws particularly in Canada, as compared to the rest of the world (see Figure 01).

Figure 01: Google Trends "Real estate bubble" (data source: www.google.com/trends)

No surprise therefore, that also in more fundamental economic analysis, Toronto and Vancouver are ranking 1st and 4th on the UBS Global Real Estate Bubble Index for 2017 [UBS 2017].

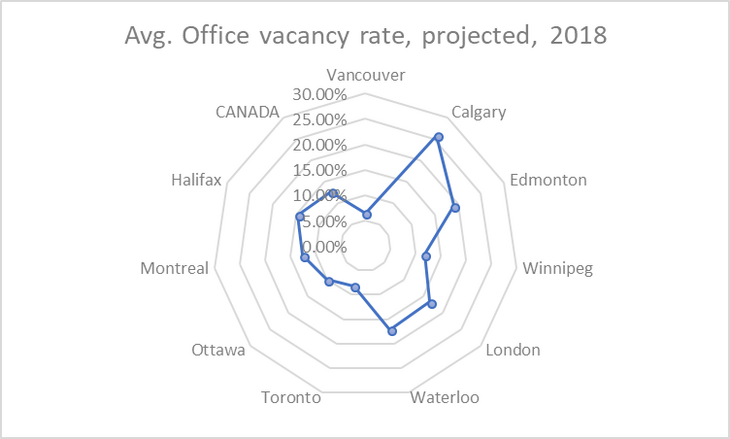

On the other hand, commercial real estate markets in Canada are continuously setting new records and retain momentum, recording the highest CRE investment volume in the nation’s history in 2017 [All data in this section according to CBRE 2018], at $43 bn, while the average cap rate [Capitalization rate, the ratio of net operating income to property asset value] fell slightly, to a low of 5.69%, but still with a solid 365 bp spread above 10-yr bond yields. But these figures again conceal a rather inhomogeneous reality, where the projected average national office vacancy rate 2018 may be settling at a comfortable level of 12.7%, but with wide regional deviations (see. Figure 02).

Figure 02: Projected average office vacancy rate 2018 (data source: CBRE, 2018)

Overall, it is not quite clear if the bubble will continue to grow, is about to burst soon, or has already seen its maximum expansion and how fundamental political and economic uncertainty could translate into shocks with ripple effects onto banks’ profitability and, more importantly, risk levels.

Consequently, the Basel Committee has updated the risk weights in its pillar I credit risk standard approach significantly to broaden the risk sensitivity to real estate exposure, and in particular to cash flow dependent "income-producing" variants of residential and commercial real estate (IPRRE/IPCRE) [BIS, 2017].

To cut the matter short: It seems that certain real estate markets have developed or are tending to develop price bubbles, and there are plenty of indicators (pragmatic and scientific) to identify such price bubbles. Sustainable and effective real estate risk management, however, is demanded regardless of the current or particular market situation. Risk management is not only required in a crisis but instead should help the institution get around the crisis. Sustainable real estate risk management has to be applied throughout the economic cycle.

Value driver analysis: key to good real estate risk management

As we would like to point out, it is neither sufficient nor significant to determine whether or not an actual real estate bubble prevails. More importantly it is essential institutions have the adequate toolkit in order to be capable of measuring the effects of such a bubble or other market disruptions on their own portfolio, and then take countermeasures proactively. Suitable management instruments include reduction of exposure through more restrictive lending criteria or decrease of risk taking and risk concentration through syndicated loans. A very important component of diversification is, however, that all relevant risk components in the real estate segment are being identified, measured, managed and supervised across all divisions of the institution. It is not sufficient to manage diversification only through type of object and location, to name the most common examples.

Instead, the value drivers of properties need to be at the focal point of the analysis.

To get started, a simple observation may help:

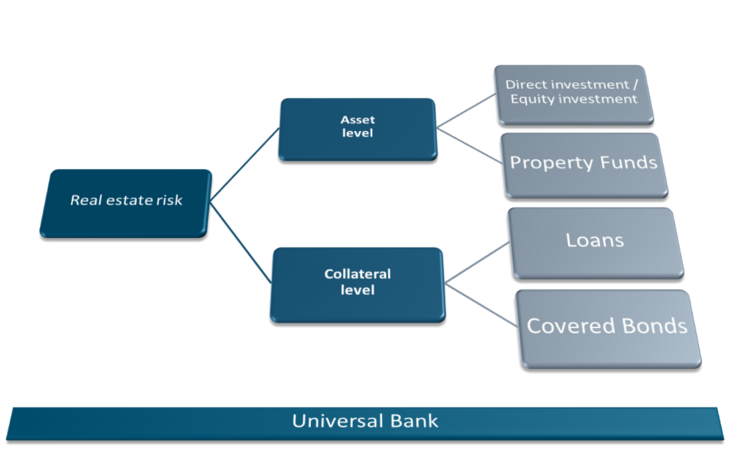

Real estate risk can be realized both on the asset or on the collateral level. Direct or indirect investment into property or shares in real estate investment funds present the more obvious exposure, while real estate as collateral should be regarded as equally important, be it as primary collateral from the lending process, or as a dependency on the collateralization level in financial instruments such as covered bonds (see Figure 03).

Figure 03: Fundamental categories of exposure to real estate risk

With this in mind, we can look closer into an approach how to set up a more detailed value driver based risk analysis and management process.

Integrating different types of risk into one holistic perspective

We propose to consider three aspects in order to be able to successfully integrate the different hidden layers of risk into one holistic view and bank management approach.

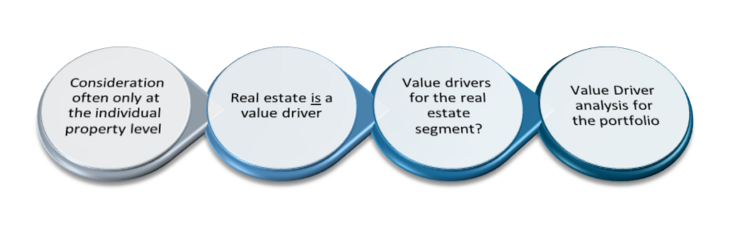

A) Understanding that real estate risk has to be elevated from a view of the individual property level (see Figure 04).

Figure 04: Evolving thought process, from know-your-property to portfolio-wide value driver analysis

- Loan origination and adjudication processes typically ensure that at the individual properly level very detailed information is captured and available

- This fosters the perception that real estate actually is a value driver; the value of real estate is a driving factor for a variety of investments pursued by financial services providers (banks, insurance companies)

- From here, it is only a small step to come to question as to what the value drivers of real estate property in fact are. “Location, location, location” certainly is the most commonly cited predominant factor, but with closer analysis it is important to realize that type of object (and with it, demand and type of use such as office, industrial, residential or retail space) as well as the economic capacity of tenants/occupants/operators on which a given IPCRE or IPRRE depends. This in turn will depend on background factors such as the business segment (e.g. retail) a given tenant operates in.

- Once all these drivers have been established, it is possible to implement a value driver analysis that looks at the entire real estate portfolio

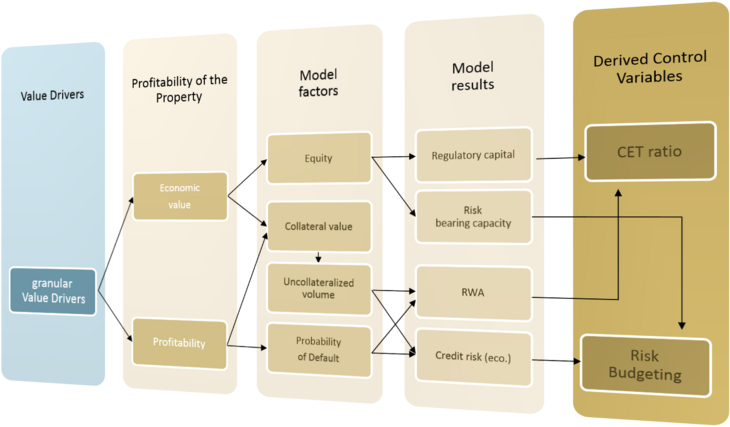

B) Categorizing, taking stock of, and analyzing all value drivers and their implications (see Figure 05).

Figure 05: Value drivers impacting aggregate bank management KPIs / KRIs

- With the proper (granular) value drivers established, their effect on valuation/profitability, and, next, on more complex model factors such as PD/ LGD can be analyzed

- This will provide insight into the dependency of institution-wide KPIs and KRIs including risk weighted assets and economic capital on the original background drivers.

In our experience this is often a missing link that has not been condsidered sufficiently in practice, and it is this area of expertise where innovative approaches and tools can generate fundamental insights, strengthening the financial institution’s risk management procedures.

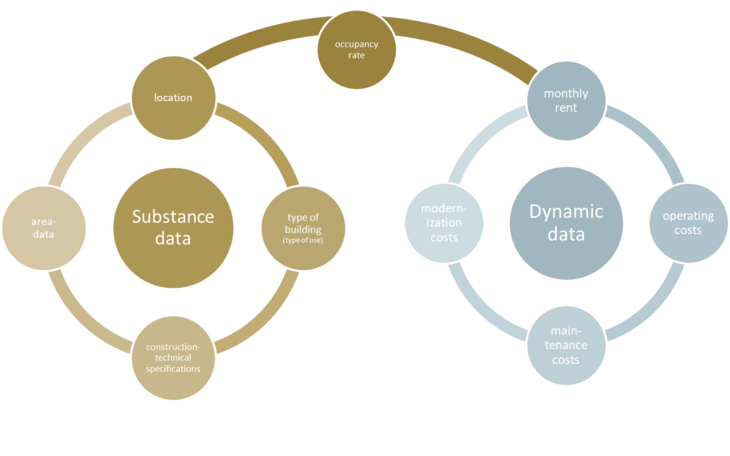

C) Accordingly, we need to establish a frame of reference for capturing the required data that allow us to express and statistically connect the value drivers (see Figure 06).

Figure 06: Substance and dynamic data

We will distinguish three types of data

- Substance data, which are fundamental factors affecting the physical features of the property including location, type of building, and technical specifications

- Dynamic data, which are flow data concerning operating and maintaining the property on an ongoing basis

- Utilization based data, such as occupancy rates in rental properties or vacancy rates in office buildings

Only by taking all these dimensions together and establishing the proper modeling, valuation, stress testing and scenario generating procedures, will the financial institution be able to ensure consistent integrated reporting from property level up to integrated economic bank management and KPIs.

We will now return to the two categories of exposure to real estate risk that we mentioned in the introduction, and explore these concepts in more detail by means of the example of an income producing rental property (IPRRE) and an income producing office lease property (IPCRE), respectively.

Real Estate exposure from direct investment

The case of direct investment into an IPRRE already requires a solid valuation approach that provides clues as to which background factors we should consider as our value drivers.

In the appraisal or periodic reappraisal process, the most commonly used valuation approach is the Income Approach. This requires an assessment of the Net Operating Income which, combined with an expected yield/cap rate for the market environmentm, will result in a market value estimate for the individual object (see Figure 07).

Figure 07: Income approach, schematic

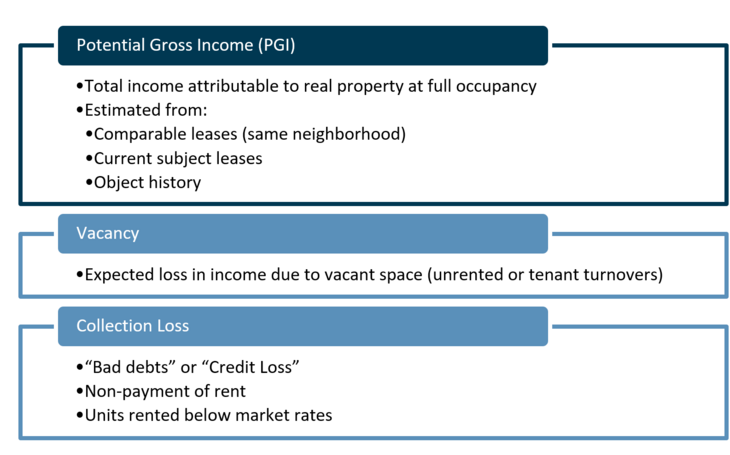

Net Operating Income in turn is derived as the difference between effective gross income (potential gross income less deductions for vacancy and collection losses) and operating expenses (see Figure 08).

Figure 08: Components of effective gross income (EGI); subtracting operating expenses yields NOI

The value drivers we can deduce at this point are therefore all factors that also drive PGI, including

- rental income (-> the more knowledge about the credit quality of tenants, the more accurate the income estimate),

- cap rate (-> from comparable market valued objects, or through more detailed weighted average methods in use) and

- anticipated remaining lifetime of the property over which income will be be generated.

All this information can be incorporated into a net present value-type view of relative profitability of the property, derived from primary value drivers.

Real Estate exposure from collateral

Considering the asset class of IPCRE (e.g. financing of a shopping centre with large prime retail tenant), it is straightforward to see why PD and LGD parameters are actually connected if not intertwined: the economic situation (in this case the ability to repay a loan) of the borrower determines at the same not only his credit rating/PD with debt service coverage ratio (DSCR) as the primary driver, but also potentially the value of the property itself: Imagine that the prime retail tenant reduces the leased space and this cannot be compensated through other tenants or only at reduced rates – in this situation the DSCR for the IPCRE will reduce as well as the value of the real estate. Both methods (DSCR-based rating and real estate appraisal) are heavily influenced by the expected tenant rate and the vacancy rate. Now consider the case where one prime retail tenant may be involved in multiple objects at multiple locations [the distribution across multiple location gives an unjustified security]. It is rather obvious how the background factor "economic health of the retail sector" affects credit risk in multiple ways.

When we focus on loan collateral, it is important to point out that one of the main risk-drivers is the value of the collateral. The loss in collateral value will result in a larger unsecured portion of the related loan. In terms of credit risk it is quite common to rely only on an exposure-specific LGD. In complex collateral situations, like a bundle of N credits and M collaterals, it is difficult to translate collateral value changes into an exposure-specific LGD figure. We therefore recommend computing a collateral-specific LGD (RR – recovery rate by collateral) wherever possible.

The expected tenant rates (or vacancy rates) are the main drivers for "land acquisition, development and construction" (ADC) exposures. At the end of the day the expected tenant rate drives the potential real estate value and, as a consequence, the land price. In its Basel III update, the Basel committee underlines this by introducing the (partly) new high risk credit category ADC (see [BIS 2017]). Traditionally, financial institutions use scenario analyses to simulate collateral values, e.g. by simply applying stressed cap rates/lease rates. In the asset category IPCRE, again, this falls short, and therefore scenario analysis has already been expanded to capture the link between PD and LGD, both connected via DSCR.

Analytical treatment in credit portfolio risk modeling

We argue that it is insufficient to leave it to scenario-based risk management, and that an analytical approach to credit portfolio risk, expressed by credit portfolio unexpected loss, is required.

Credit portfolio models such as CreditMetrics™ can be further enhanced to allow precisely this.

In the standard CreditMetrics model, rating migrations are being simulated by considering an idiosyncratic factor for each borrower as well as one normally distributed background factor for the portfolio. Applied to the rental price, we can see that a new common rental price ∆RPtotal can be random-generated, which in turn is calculated using an idiosyncratic factor RPi and another background factor YRP. This factor then models both the individual rental price movements of the property as well as the overall influence of the real estate market:

∆RPtotal=ρ∙YRP+√(1-ρ^2)∙RPi

Formula 01: property rental price, adjusted factor model

Based on the adjusted overall rental price it is then possible to derive the expected cash flow/NOI of a given property and compare it with the cash flow for loan and interest repayment, which yields the DSCR accordingly. This now closes the loop, since DSCR will also serve as the main input into deriving the PD of the borrower. As a result, the (common) background factor influences PD and LGD factors from a real estate risk perspective.

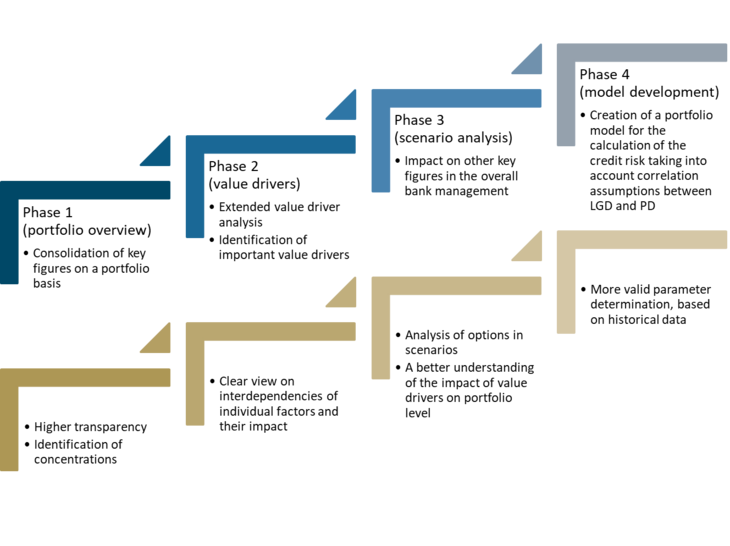

Four-stage approach to assessment and implementation of a holistic framework

In order to address the various modelling challenges outlined so far, and to create a holistic real estate risk management framework, we suggest an approach comprising of four major stages (see Figure 09):

- Assess and consolidate granular key data across the portfolio

- Identify the primary value drivers and determine their dependencies

- Extend the existing scenario analysis to include value driver impact on credit risk and bank management key indicators

- Improve the credit portfolio modeling framework by allowing for real estate related background factors

Figure 09: Four-stage approach to holistic real estate risk management

Summary

With real estate exposure, both direct and indirect, constantly increasing on banks‘ balance sheets, adequate management of the inherent risks has become more important than ever. However, many institutions still lack appropriate concepts to capture and monitor real estate risk. Instead of looking at the individual loan or property, risk assessment on a portfolio level focussing on the common risk factors that drive portfolio risk is crucial.

In this article we have concentrated on the expetced rental price as a very influential risk driver. A simple extension of standard credit risk models allows for a substantiated and realistic analysis of real estate portfolio risk and captures the link between PD and LGD.

A proper model implementation (and building up a data foundation) will be challenging and we therefore propose a four-stage project approach to achieving a holistic real estate risk management

List of References

[1] Bank of Canada, "Financial System Review", 11 2017.

[2] UBS, "UBS Global Real Estate Bubble Index", [Online]. Available:

[3] CBRE Research, "2018 REAL ESTATE MARKET OUTLOOK Canada", 2018

[4] BIS, "Basel III: Finalising post-crisis reforms", 12 2017 [Online]. Available:

www.bis.org/bcbs/publ/d424.htm

Authors:

Volker Liermann – Partner – ifb AG – Volker.Liermann@ifb-group.com

Nikolas Viets – Director – ifb International AG – Nikolas.Viets@ifb-group.com

Stefan Grossmann – Senior Director – ifb Canada, Inc. – Stefan.Grossmann@ifb-group.com