This year’s AllianzGI RiskMonitor finds the risk management strategies employed by institutional investors need an urgent overhaul. Although two in five institutional investors admit the methods they used during the recent global financial crisis did not provide sufficient downside protection, they have taken no action to change the status quo.

The strategies institutional investors used to manage risk in one of the most difficult times in modern investment history, which is the financial crisis, are almost identical to those still used today. Asset class and geographic diversification remains the most widely used risk management strategies pre and post crisis.

This is particularly important given the rougher investment climate expected this year. Unsurprisingly, institutional investors say market volatility is their main investment concern in 2016. Add to that the other big concerns this year - low yield and uncertain monetary policy and there is little doubt that investors are in for a bumpier ride compared to the last few years.

Given the choppy markets early this year and more turbulence on the cards, apprehension around equity-market risk remains entrenched in investors’ minds as it continues to be the top threat to portfolio performance this year as well although the worry expressed in this regard seems to have escalated considerably.

Interest rate risk, event risk and foreign-exchange risk are also high on the list of threats that could derail their performance. However, the concerns around market turbulence and equity market risk have not been converted into a wide-spread defensive attitude. Institutional investors report their primary investment goal for 2016 is to maximize their risk-adjusted returns; generating yield, benchmark outperformance and absolute return being other objectives.

Further, their inclination towards equities suggests their risk appetite has not been completely dampened by the market volatility. In particular, US equities and European equities garner the top spots among the investments earmarked for long exposure again this year.

Alternatives are also gaining traction with institutional investors since they provide diversification to their portfolios. Illiquid assets also seem to be favored by many who believe they will provide returns in addition to diversification. Meanwhile, ESG integration still has some headway to make with corporate mandate still being a major driver of ESG usage.

The AllianzGI RiskMonitor seeks to glean the impact the market environment has had on the sentiment, attitudes and behavior of institutional investors. This report identifies investors’ most pressing concerns, their objectives for the year ahead and analyzes their behavior in the face of the increased volatility.

New risk management strategies

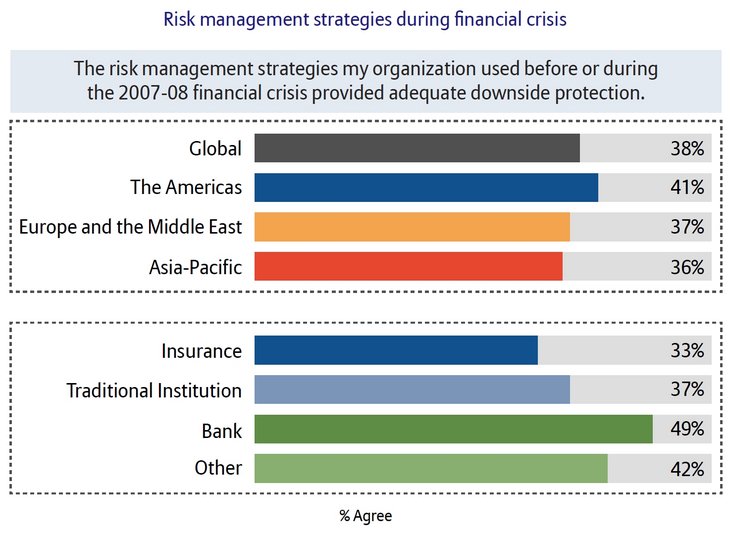

The risk management strategies employed by institutional investors need an urgent overhaul. Although only two in 5 (38%) institutional investors say the strategies used during the recent global financial crisis provided sufficient downside protection, little action has been taken to change the status quo and the strategies being used now have barely changed since 2008.

The strategies institutional investors used to manage risk in one of the most difficult times in modern investment history, that is throughout the financial crisis, are eerily similar to those still used today. There is no change in the predominant strategies among investors with asset class and geographic diversification remaining the most widely used.

Source: AllianzGI RiskMonitor

The top three strategies investors used by global investors before or during the 2007-2008 financial crisis included asset-class diversification strategies (57%), geographic diversification (53%) and duration management (44%). There has been some increase in certain strategies like risk budgeting or tail risk hedging but the main strategies remain the same.

Dynamic asset allocation also seems to be a popular risk management strategy considered by institutional investors. Asset allocation is a function of many things including risk tolerance, investment time horizon and market environment among others. Dynamic asset allocation allows investors to process new information about the market environment and set allocations accordingly in contrast to a static allocation.

The lack of change in risk management strategies pre and post crisis is consistent across the globe, underlining the need for an international review.

Source: AllianzGI RiskMonitor

This uniformity would not raise concerns had these strategies provided the necessary protection. However, only 38% of institutional investors said their risk management strategies provided them with adequate downside protection during the crisis. Therefore, the fact that they continue to favor the same strategies that proved not fit for purpose in a time of high stress should raise alarm among investment professionals serving this part of the market.

Take the example of alternatives. Two thirds (67%) of institutional investors claim to have a good understanding of alternatives. The fact that this is lower than the number of investors allocating to these asset types suggests there is a slight disconnect between knowledge and investment where some institutional investors are putting money into strategies they do not fully understand.

A considerable portion (60%) say they take into their own hands the matter of measuring the risks posed by alternative assets even as a third (32%) say they rely on external consultants to measure and manage these risks on their behalf.

A significant number of investors (38%) feel they do not have the necessary tools to assess the cash flow patterns or liquidity risk associated with alternative investments. The clamor for better risk management tools in the realm of alternatives (62%) seems even more sensible in this light. In fact, the call for better risk management tools associated with alternatives got louder this year (62% compared to 49% last year).

However, in the same breath, institutional investors are unwilling to sell themselves short with three in five (60%) saying they are able to measure alternatives risk effectively. This suggests that although they might consider the measurement methods operational and fit for purpose, they need assistance when it comes to managing the risk they measure.