No sooner had new CEO John J. Ray III taken over at the insolvent crypto exchange FTX than he described the situation as a "unprecedented situation", with a total failure of corporate governance. This assessment carries weight, as Ray already took the helm in the past after one of the biggest frauds in the world (to date) - namely Enron. In the Financial Times, he charged that all internal controls had failed, and that no trustworthy financial information was available. In particular, he criticized "compromised system integrity" and an excessive concentration of power among a small group of "inexperienced, unsophisticated and potentially vulnerable" individuals. It is all the more surprising, then, that historically neither regulators nor auditors have noticed that the FTX ship was sailing in the stormy crypto sea without effective risk management or an internal control system.

To the moon and back!

Like numerous major scams in the past, FTX rushed from one record to another for a long time and its founder, Sam Bankman-Fried, was hailed as the "golden boy of the crypto world". More appropriate might be the name "Scam Bankman Fraud," as Stanford professor Martin Kulldorff suggested on Twitter. The ex-CEO speaks of an unfortunate "miscalculation of risk and leverage." But a look behind the scenes reveals more of a corrupt system with pronounced risk blindness.

The collapse of FTX, in turn, triggered a chain reaction across all crypto stocks and exchanges. For example, Genesis, one of the market-leading crypto brokers, declared that it would no longer issue new loans and would stop repaying them until further notice. To put this in perspective, the company issued over $130 billion in crypto loans in 2021.

With prestigious venture capitalist Sequoia Capital and Softbank CEO Masayoshi Son's Vision Fund, big-name investors already wrote off their FTX shares entirely. The sovereign wealth fund of the city state of Singapore also suffered a total loss of 275 million US dollars.

Prominent advertising faces for FTX, such as Gisele Bündchen or Tom Brady, could be burdened with considerable problems if bruised buyers are able to successfully enforce their planned class action lawsuit. That's because the plaintiffs' lawyer in charge argues that "such a Ponzi scheme can only succeed with the help and publicity of the world's most famous and popular celebrities." And no one had taken relevant early warning indicators seriously.

When partners become fierce competitors

Crypto exchange Binance is taking a key role in FTX's fall. Initially, Binance founder Zhao Changpeng had still invested in FTX in 2019, but the two companies quickly diverged. Binance had to contend with critical regulators, while FTX and Bankman-Fried were able to boast numerous prominent backers - and regulators tended to be conspicuous for their pronounced risk-blindness. Among other things, the company secured the naming rights to the Miami Heat stadium for 19 years and hired Tom Brady, the star of the NFL football league, as its "ambassador. Bankman-Fried was considered the up-and-coming crypto king. Changpeng and Binance ended their investment in FTX and received FTT tokens and Binance USD equivalent to around two billion US dollars.

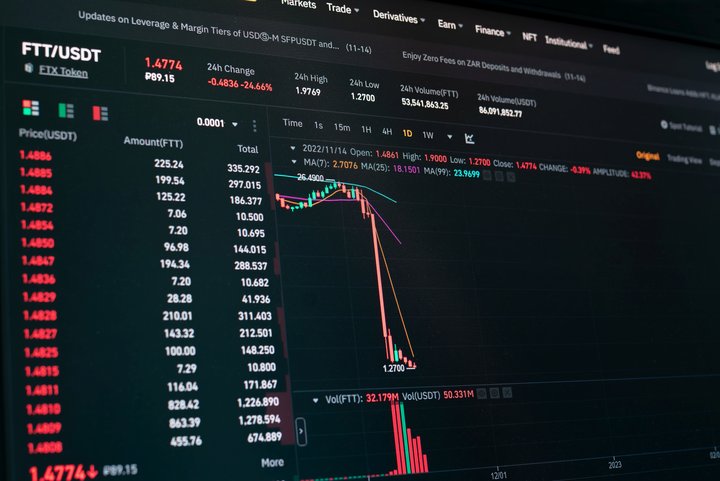

It was precisely these FTT tokens that played an important role in FTX's demise, as Changpeng announced on Twitter on November 6, 2022 that he wanted to sell his shares due to the "recent revelations that came to light." He was probably referring to a report by Coindesk on November 2, 2022, in which the relationship between Alameda Research and FTX in particular was heavily criticized. Thus, both houses were accused of being too closely intertwined. Alameda manages assets worth $14.6 billion, according to the report, much of it FTT tokens. It was quickly speculated that the company did not hold enough liquidity and that the token was merely "hot air." The tokens were created virtually out of thin air. The hedge fund Alameda Research had extended a loan of USD 1 billion to Sam Bankman-Fried. And in parallel, chief developer Nishad Singh also received a loan in the amount of USD 543 million. At the same time, Sam Bankman-Fried is said to have transferred FTX funds of around USD 4 billion to Alameda Research. These funds are said to have been customer deposits to increase Alameda's risk-bearing capacity or to save the company from insolvency.

In connection with Alameda Research there is various "gossip", of which it is not conclusively known how high the respective truth content is. The fact is that their CEO Caroline Ellison is repeatedly the center of attention. Polyamorous relationships are reported and she is said to have had a liaison with Bankman-Fried. Together with eight other people, both are said to have lived in a 30 million dollar penthouse in the Bahamas until shortly before the publications. What is probably now considered confirmed: the "risk manager" was not particularly conservative - at least in terms of professional risk appetite and the lack of elementary components of good risk management (more on this later!). In interviews, the 28-year-old at least confirmed the suspicion that she did not think much of effective and quantitative risk management. She pointed out that basic arithmetic would be quite sufficient for managing FTX risks. This is all the more surprising given that Caroline Ellison studied mathematics at Stanford University. She was characterized by Ruth Ackerman, one of her instructors, as "bright, focused, very mathy". But Ellison may never have learned that effective risk management is based on sound methods, adequate organization, and a practised risk culture. Instead of addressing the implementation of effective risk management, she preferred to philosophize about gender roles, culture, and society on Tumblr. Incidentally, growing up in an academic family, Gary Gensler, the current chairman of the U.S. Securities and Exchange Commission, was once her father's supervisor at the Massachusetts Institute of Technology (MIT).

Like FTX founder Bankman-Fried, Ellison comes into contact with the philosophical movement of "effective altruism" during her time at Stanford and becomes a member of the "Stanford Effective Altruism Club." The movement aims to make the best use of limited resources, time and money, to improve the lives of as many sentient beings as possible. To what extent this goal was supported with the FTX bankruptcy, each reader may judge for himself.

Speaking of unanswered questions: The Coindesk report did not prevent Binance CEO Changpeng from wanting to take over FTX at the beginning, but this should ultimately be passé with his Twitter statement. So far, it is not known who the source of the leaked information and documents behind the report is, and speculations already arose that Changpeng deliberately sidelined his main competitor. In the Bloomberg Billionaires Index, Bankman-Fried's wealth was corrected from 16 billion to 991 million US dollars in one day. As a result, there were already reports that wrote in Hollywood style of the "perfect murder" of Bankman-Fried by Changpeng Zhao.

Lots of castles in the air

In the last major financing round, FTX was valued at 32 billion US dollars. A serious audit of the accounts did not take place...

The inadequacies uncovered by Ray after just one week read like a list of shortcomings that would make any risk manager gasp in horror:

- Many of the FTX Group's 130 companies, particularly those in Antigua and the Bahamas, did not have adequate corporate governance, nor had they ever held a board meeting.

- There were significant procedural deficiencies in cash management, including missing lists of bank accounts and authorized signatories.

- Company funds were misappropriated to purchase homes and other personal items for employees and consultants.

- A risk management system or internal control system existed as a paper tiger, if at all.

Calls for tougher regulation

Almost reflexively, calls for stricter rules and regulations follow every major fraud case. For example, U.S. Treasury Secretary Janet Yellen made a strong case for stricter oversight of the crypto industry. But no one is addressing the question of why existing oversight, as well as auditors, have completely failed. And as with all previous corporate failures, the blame game starts all over again. Nobody knew anything and nobody is to blame. The others are always to blame ...

Excessive hubris

Bankman-Fried (apparently) still sees no fault in himself, but looks for it in particular in the regulator. In an interview with Vox, which he later retracted, he called the bankruptcy announcement ("Chapter 11") his "biggest mistake" and went on to say "If I hadn't done that, withdrawals could start in a month and customers would be fully compensated."

Last weekend, Bankman-Fried and the remaining employees were desperately seeking potential investors to fill the $8 billion liquidity gap and compensate each of the one million customers.

When billions disappear without a trace...

As was the case a few years ago with Wirecard, where the then CEO Markus Braun wanted to take over Deutsche Bank, which was many times larger, right to the end with the megalomaniac goal under the code name "Project Panther", the bubble ultimately burst and no one knew where the billions had gone. In the case of Wirecard, the fairy tale of the "gigantic fraud" that Wirecard AG had fallen for was repeated mantra-like.

And at Wirecard, too, the fraud scheme was accompanied by ineffective risk management. In the annual financial statements audited by the auditor, the authors rave on about 20 pages about the high degree of maturity of Wirecard's risk management. They write of value-oriented corporate management and of the company's overfulfillment of relevant international standards and regulatory requirements. And, of course, there were no scenarios threatening the company's existence.

In the case of FTX, too, it is not clear today where the missing billions have ended up. American media repeatedly refer to "unauthorized transactions". The amounts involved a range from four to ten billion US dollars.

Same, same but different

Mark Twain would have been delighted with the analysis of the FTX case, especially since his thesis that history "does not repeat itself, but rather rhymes" seems to be confirmed:

- "backroom" decisions: at FTX and its sister company Alameda Research, all major decisions were made by the "polycule" group, the ten roommates who, according to reports, had been romantically or even sexually involved with each other for at least some time. The question of where the billions of euros in customer deposits have remained is as unresolved as the legendary question of the same nature at Wirecard.

- Intransparent company network: "The FTX Group" comprises(s) a structure of more than 130 companies spread over several countries. Most of the companies did not keep audited balance sheets.

- Dubious characters: FTX's "Chief Regulatory Officer," Dan Friedberg, was involved in one of America's largest online poker fraud cases about ten years ago. He was UltimateBet's lawyer at the time and advised executives on a strategy to limit payouts to victims, among other things. In August 2021, cryptocurrency news site CoinGeek addressed the dubious personnel constellation, calling Friedberg's appointment "almost comically inappropriate" due to his past. The author further noted that it "somehow remains a mystery" how Friedberg "managed to avoid disbarment" after records of his involvement surfaced.

- Failure in corporate controls and no trustworthy financial information: While this is the (!) classic in the biggest frauds of our time, FTX nevertheless seems to have topped it all off once again. Because the newly appointed CEO called this unprecedented in court documents. Mind you: John J. Ray III had already cleaned up Enron!

- Amateurish internal processes: Probably the most vivid example of how unprofessional and amateurish the internal processes in the billion-dollar FTX company (apparently) were, can be seen in the example of salary payments. For example, employees submitted their requests for wages in an online chat, which were approved by supervisors through personalized emojis.

- Regulators under criticism: As with Wirecard, FTX also came under considerable criticism from the regulator. For example, Bankman-Fried said in a Vox interview that his expressed open attitude toward regulators was "just PR". However: banking regulators (so far) are not even responsible for the largest parts of the crypto market. That is why, for example, the head of the German banking regulator BaFin, Mark Branson, called for the banking system to need a protective wall against the crypto market. In this regard, however, it will be crucial that supervision is internationally coordinated and that effective tools for early detection are used.

- Prominent and influential "ambassadors": Enron was probably the best-known precursor when it came to very targeted lobbying. Thus, the central requirement for managers was to network closely with politicians. In the case of FTX, it was not only politicians (FTX was the largest donor to the Democrats in the 2022 midterms after George Soros with 36 million US dollars), but in particular prominent advertising faces and advocates whose reputations were specifically used. Ethereum founder Vitalik Buterin states in a Twitter post that the scam is the worst crypto scam to date because FTX has always "staged itself as particularly virtuous and law-abiding."

- Greed eats brains: also a classic of the biggest scams! Alameda promised potential investors a 15% return in a 2018 pitch deck - with (supposedly) no risk. - A combination that should strike any good risk manager as odd! But when no risk management exists, risk blindness dominates!

Authors:

Frank Romeike is founder and managing partner of RiskNET GmbH - The Risk Management Network. He was Chief Risk Officer (CRO) of IBM and has published several standard works on risk management and stochastics.

Dr. Christian Glaser holds a doctorate in risk management and is the chief representative of a well-known financial services provider. He is also a lecturer at several universities and author of several textbooks as well as numerous professional publications in the fields of financial services, corporate governance and management, controlling as well as risk management.