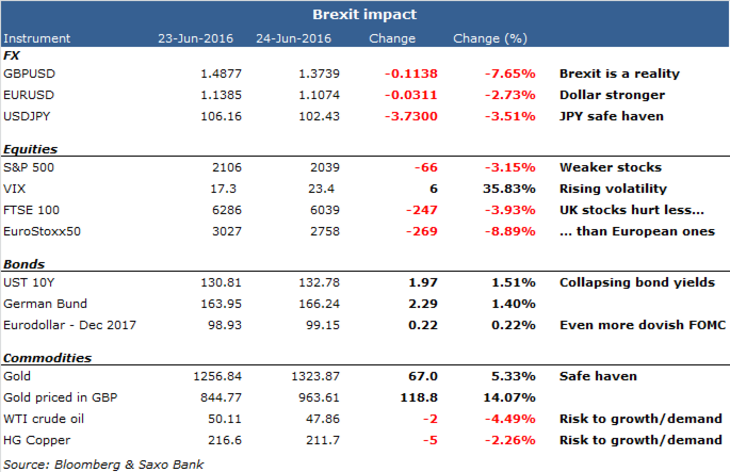

The United Kingdom has voted to leave the European Union in a vote that was given this comment by the Financial Times: "Biggest jolt since the fall of the Berlin Wall. This puts 70 years of EU integration into reverse".

Indeed, the decision to leave caught financial markets completely off-guard, not least considering how polls in the days leading up to Thursday had been indicating a win for the Remain camp.

Sterling plunged from over 1.50 to south of 1.3250, from a year-to-date high to a year-to-date low within six hours. This, the biggest one-day move ever, was followed up by a plunge in the FTSE futures by nearly 9%, a move which wiped out a value equivalent to 15 years worth of EU contributions.

German 10-year bund yields touched a record low of minus 0.17% while USDJPY plunged below 100.00 as panicked investors sought any port in the storm.

Brexit impact

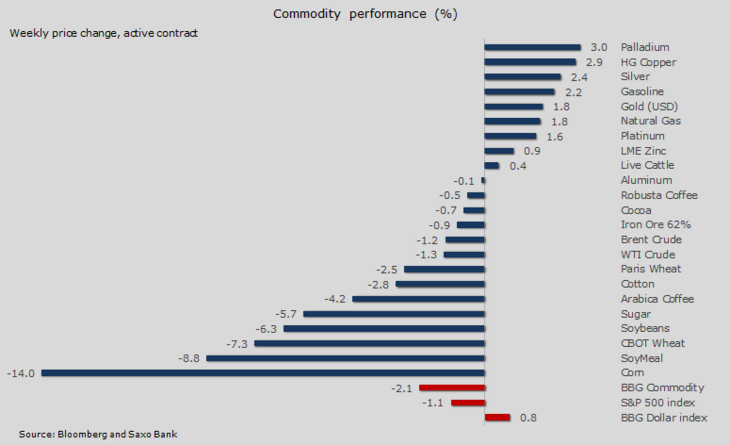

Most commodities with the exception of precious metals tumbled amid the global flight from riskier assets. This came in the wake of a major buying spree from speculative accounts during the past two months which left many commodities exposed to long liquidation, not least due to a surging dollar and the general collapse in risk appetite.

Gold benefited the most from this emerging chaos. The initial rally was strongest against GBP and EUR. Against USD, a 100-plus dollar range was seen during the Asian session with trading volumes on COMEX futures surging to more than 700% above the average of the past 100 days, reports Bloomberg.

Industrial metals saw a rush to the exit with the Brexit vote raising some global macroeconomic concerns. Despite tumbling the most since January, copper was still one off the the best performing commodities on the week. This primarily driven by short-covering from funds that held a record net-short position in the futures market on June 14.

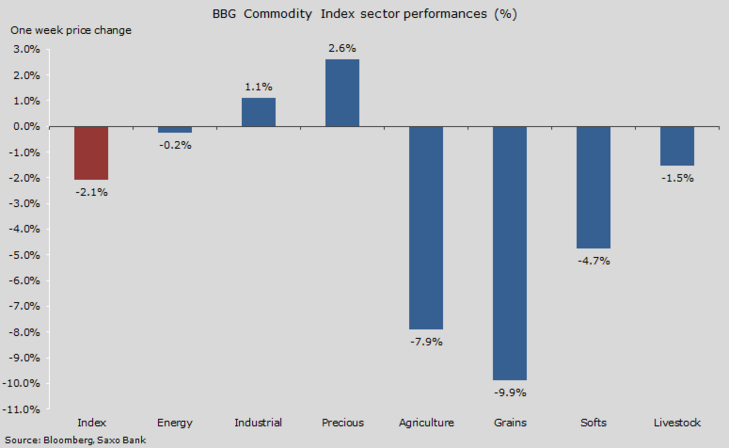

One week sector performance

Overall, the Bloomberg Commodity Index was on track to record its second biggest weekly loss this year with profit taking primarily hitting the agriculture sector where speculative buying had resulted in the number of bullish bets hitting a two-year high.

The rapid build in speculative positions by hedge funds have primarily been focusing on soybeans, corn and sugar, and these three are all found at the bottom of the table.

One week performances

Crude oil got caught in the turmoil with the prices of Brent and WTI both falling by more than 6% before stabilising. The selloff, however, stopped short of breaking the recent lows which could indicate that no damage has been done to our expectations of a medium-term range between $45/barrel and the low 50s.

Although some concerns have emerged about global growth and demand, we should not forget that oil is already in the process of rebalancing. A lower price at this stage will only help speed up this process considering how it would prevent high cost producers from stabilising, let alone increasing production.

The biggest risk to oil comes from the fact that funds remain long close to a combined 600 million barrels of crude in WTI and Brent. A prolonged period of market turmoil may trigger additional selling, thereby extending the weakness beyond what is currently warranted.

As per the chart below, the uptrend in Brent crude oil from January remains challenged but we view the risk of much additional weakness below $45/b as being limited unless the global rout increases.

![Brent Crude oil, first month cont [Source: SaxoTraderGO] Brent Crude oil, first month cont [Source: SaxoTraderGO]](/fileadmin/_processed_/4/9/csm_04_SAXO_Hansen_20160627_a6594d3a47.png)

Brent Crude oil, first month cont [Source: SaxoTraderGO]

Gold surged to a fresh two-year high at $1,358/oz before profit-taking and recovering stocks helped limit the upside. The main reason why gold has benefited from the British decision to leave the European Union has come from the risk-aversion hitting other asset classes, combined with the belief that this event has kicked the US rate hike can further down the road.

It could also bring the fear of contagion to other EU countries with Front National leader Marine Le Pen having promised a “Frexit” vote if she wins the French presidential election next year.

The dollar strength that we saw following the event did not hold the yellow metal back from rallying. This helped trigger an even bigger rally in gold priced in euros. With the future of the EU potentially in doubt, it makes perfect sense that risk-aversion and safe-haven demand should benefit gold priced in euros.

Gold has rallied by 25% and silver by 30% so far this year. While such impressive performances could easily deter investors from getting involved, there are no compelling reasons to expect a major correction from here.

The multiple drivers which have driven precious metals higher since January have, if anything, been strengthening from the latest developments. US interest rate hike expectations have collapsed while the diversification/re-allocation story driven by negative sovereign bond yields and concerns about global growth continues.

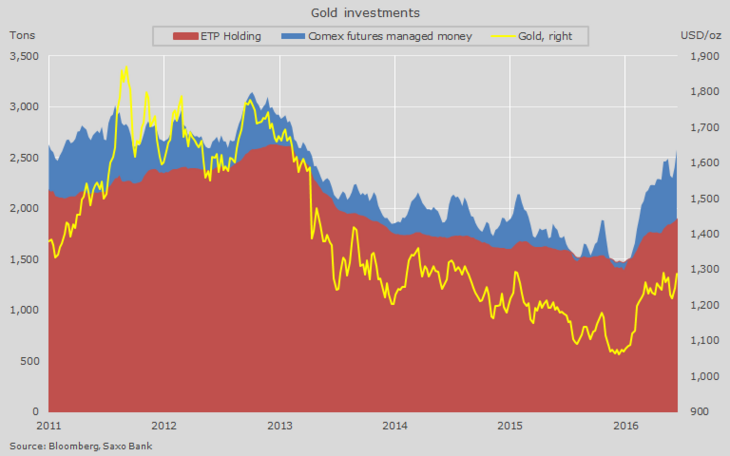

These stories have, of course, already been playing out for the past six months but as long ETF investors continue to add length – thereby drowning out subdued physical demand support should be firm.

The latest rally is likely to have created a new range some $75 above the previous one. Support should now be found between $1,300 and $1,275/oz with the medium term target pointing towards the 2014 high just below $1,400/oz.

![Spot Gold [Source: SaxoTraderGO] Spot Gold [Source: SaxoTraderGO]](/fileadmin/_processed_/1/d/csm_05_SAXO_Hansen_20160627_ba4d67dbc7.png)

Spot Gold [Source: SaxoTraderGO]

Just as with oil, the biggest risk to gold comes from extensive positioning. Since May, demand for exchange-traded products backed by physical gold has been rising on an almost daily basis while hedge funds following a one-third reduction in May have returned as strong buyers during the first two weeks of June.

With the fundamental support growing following the Brexit, any retracement should be met by increased investor allocation into the yellow metal.

Gold investments through futures and ETP

Author:

Ole Sloth Hansen is a specialist in all traded Futures, with over 20 years’ experience both on the buy and sell side. Hansen joined Saxo Bank in 2008 and is today Head of Commodity Strategy focusing on a diversified range of products from fixed income to commodities. He previously worked for 15 years in London, most recently for a multi-asset Futures and Forex Hedge fund, where he was in charge of the trade execution team.