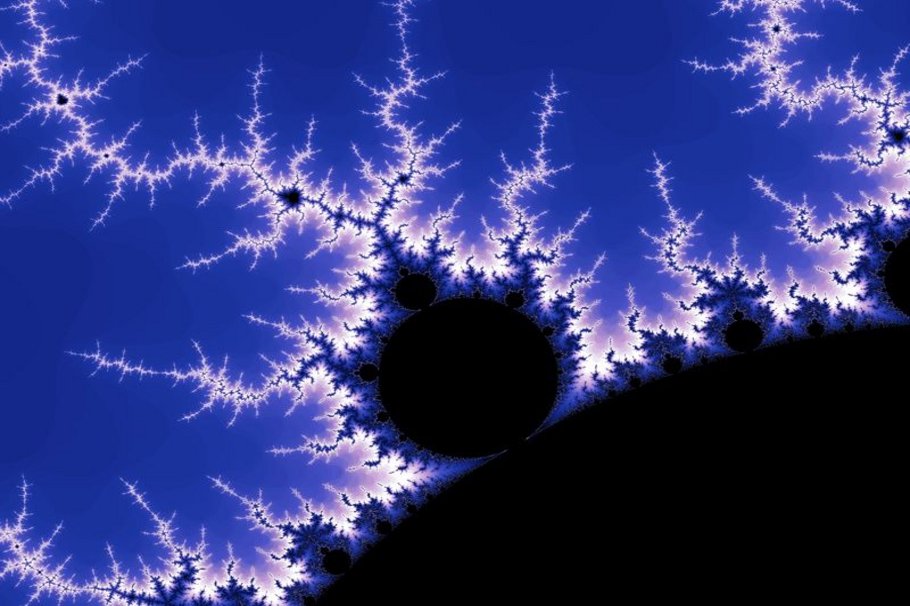

The assumptions of Gauss have formed the basis of public finance for more than a century. Traditional models and analytical methods for portfolio maximisation usually rest on the assumption that asset returns follow a normal distribution. In practice, this means the following: It is much more likely for an equity portfolio to have small percentage daily gains or losses than medium-sized or large upward or downward movements. This approach was questioned for the first time in the mid-1960s by Benoît Mandelbrot. Renowned for his research in the area of fractal geometry, Mandelbrot claimed that normal distribution was not an accurate reflection of reality on the financial markets. Price fluctuations on the stock markets were much more extreme than was presumed in conventional financial mathematics models.

Why has it taken so long – despite empirical academic studies – for the financial services world to understand that the probability of large losses is far higher than the Gaussian bellshaped curve predicts? It wasn't until the painful experiences of the financial crisis that greater attention was paid to the analysis of "fat tails".

Stefan Mittnik: There are many reasons for this. While it is true that Mandelbrot touched on the problem half a century ago and proposed the generalised Gaussian (or normal) distribution, which he referred to as "stable distribution" and went as far as proffering a solution, it was impossible to put into practice. Even Nobel Prize winner Eugene Fama, who wrote his dissertation on this topic in 1965, soon threw in the towel when faced with the analytical difficulties and turned his attention to other challenges. At the end of the 1980s, a small academic community had begun the task of gradually transferring the standard results of normal distribution to fat-tailed distribution. However, significant time delays are always associated with the practical implementation of new academic solutions. In the world of finance, where there are strong monetary incentives, things move much more quickly. Nevertheless, the same pressures to meet regulatory requirements at the lowest possible cost apply to the financial sector, too. It wasn't until the end of the 1990s that Alan Greenspan also recognised that "the biggest problem we now have […] is the fat-tail problem". Unregulated hedge funds were the first to take advantage of the new academic results.

On 3 May 2012, the Basel Committee on Banking Supervision released its proposals for a "Fundamental review of the trading book". Among other things, the paper proposes a move from using value at risk (VaR) to calculate capital requirements to models based on expected shortfall (ES). Such a move will capture extreme risks in a better way. Is this the right way?

Stefan Mittnik: Financial risks, whether for individual instruments or institutions or for entire financial systems, are the product of highly complex systems and processes, which cannot be met by a single risk measure. Of course, ES is an important step in the right direction, as ES subsumes the VAR measure, provides a higher information content and has other advantages as well. However, as is always the case with empirical statistics, ES is also a projection or reduction of a highly complex issue to a single dimension. Unfortunately, the notion that we can describe the risk situation with a single figure is not tenable. Although one figure is better than none. Irrespective of the risk measure selected, the challenge lies in the meaningful aggregation of risk and ensuring that the changing interaction of risk factors in stress phases is systematically taken into account. The Basel Committee proposes an ad-hoc heuristic method here for determining tail correlations, which appears to have no foundation whatsoever from an academic perspective.

Charles Calomiris (Columbia University) and Hans Peter Grüner (Mannheim) believe excessively strict government regulation to be fatal and consider that to be one of the causes of the current crisis. State deposit protection funds would have led to managers and investors feeling overly secure and therefore prompted them to take excessive risks (keyword "moral hazard"). In their opinion, the greater the protection given to financial institutions by a state security net, the greater the risk of crises in a particular country. Conversely, this means that banks must be prepared to deal with the risk of failure.

"Moral hazard" is of course a well-known problem and is also applicable. Nevertheless, the fact that financial institutions are overly protected from going under should lead to turmoil particularly among investors. The decision-makers of a financial institution, in other words, the executive boards, supervisory boards and top management, are among the losers even in the case of a rescue, since they – usually not without good reason – are forced to step down and they suffer enormous damage to their reputation. Nonetheless, high – potentially excessively high – bonus payments in the run-up to this have perhaps made this damage bearable.

A serious problem with the prevailing regulatory tendencies is that if regulation is too ambitious, it may lead to a synchronisation of decisions. If regulation were based on "correct" assumptions, this may pose less of a problem. However, it cannot be assumed that poorly paid regulators of all people understand how the complex and rapidly changing financial world operates and devise a correspondingly effective regulatory system. Statistics show that "All models are wrong". It must therefore be assumed that regulatory requirements are based on false models or assumptions. If all market players must act according to these models, situations will inevitably arise in which large numbers of market players are all wrong at the same time. In other words: A synchronisation of wrong decisions may occur, where even minor miscalculations will have systemwide repercussions. Instead of focusing more strongly on detailed regulation and standardisation, regulation should provide a sufficient degree of heterogeneity to create more resilient and more stable financial systems.

What role will the topic of education play – among other things, in risk management – to prevent or at least mitigate these types of crises in future?

Stefan Mittnik: This is badly needed on all levels. There is virtually a total lack of financial content in schools providing general education. Too many portions of the population are overwhelmed by the fundamental issue of "return and risk". Every saver and investor must be aware of the fact that high returns require high risks. Better general financial education will go a long way to reducing the crisis potential. Specific educational opportunities in the area of risk management are still severely lacking. Universities also need to fill this gap and ensure a holistic perspective that also deals with the limits of the methods used.

What lessons have academics drawn from the financial crisis and how has this influenced the research focus of the professorship?

Stefan Mittnik: The crisis has shaken up the academic world a great deal. A rethinking process is even taking place in the area of theoretical financial mathematics, which previously always tended not to let the "truth" be destroyed by facts. Elegance was traditionally more important than relevance. The question as to what extent the assumptions, which need to be made for a mathematical solution – as closedform as possible – are applicable in practice, was rarely asked and as good as never disclosed to people in the world of finance. The fact that academia has an obligation here is becoming increasingly accepted. My discipline, in other words, financial econometrics, which combines mathematics, statistics and financial theory, is based in particular on the fact that the standard statistics and econometrics tools, which are based to a large extent on the assumptions of normal distribution, do not work for many types of financial data. We are among those who benefit so to speak from the crisis. Demand for our work increases with each crisis.

In your opinion, what are the most urgent or intellectually challenging issues in risk management from an academic perspective?

Stefan Mittnik: The main challenge is posed by the high dimensionality. A great deal of progress has been made in the modelling of individual risks. The realistic aggregation of individual risks is still difficult and – depending on the type of risk – is often only feasible for a small number of factors, and even then there are considerable shortcomings. If, however, the dimension is in the thousands, we have major difficulties. A further challenge is the issue of endogeneity. Risk models and regulatory requirements are based on historic observations and experiences and are "optimised" on the basis of these. The measurement of risk alone, but even more so, adjustments to regulations, change the way in which players behave and consequently change the risk behaviour at the micro level as well as the systematic risk characteristics. Two questions always arise: Can we estimate the reactions of the individual players based on interventions? And can we also deduce the consequences for national and global financial systems? Although this problem is prevalent in all economic sectors, it is especially pronounced in the financial sector, due to the strong incentives and the many interdependencies.

Which risk management topic is your professorship currently addressing?

Stefan Mittnik: In financial econometrics, we are generally concerned with the discovery, description and quantification of correlations. Gaps in understanding are revealed particularly in times of crisis. Our group is working mostly on identifying dependencies between risk factors, primarily addressing the question of dynamics in dependency structures. This is crucial for predicting risk and developing stress scenarios. One methodical focus lies in the development of feasible methods for measuring dependencies that go beyond the standard copula approach, for example. We look at both the microscopic level by examining the limit order flow on electronic stock exchanges in nanoseconds and liquidity risks, and also look at the macro level in order to gain a better understanding of interactions between the real and financial economies. The goal of the macro studies is to develop monetary and fiscal policy instruments and strategies that can help to prevent or mitigate crises. Prof. Stefan Mittnik has been holder of the Chair of Financial Econometrics at the Ludwig Maximilians University in Munich, Germany, since 2003 and is also head of the university's Center for Quantitative Risk Analysis (CEQURA), which conducts research in the area of measuring, quantifying, modelling and managing risk and was founded as part of the German Excellence Initiative. He is a board member of the Society for Financial and Insurance Econometrics as well as a member of the supervisory board of the Union Investment Institutional GmbH, a fellow at the Center for Financial Studies in Frankfurt and was a member of the Academic Advisory Board of the Deutsche Bundesbank and of the review board for "Economics" at the German Research Foundation (DFG).

Prof. Stefan Mittnik has been holder of the Chair of Financial Econometrics at the Ludwig Maximilians University in Munich, Germany, since 2003 and is also head of the university's Center for Quantitative Risk Analysis (CEQURA), which conducts research in the area of measuring, quantifying, modelling and managing risk and was founded as part of the German Excellence Initiative. He is a board member of the Society for Financial and Insurance Econometrics as well as a member of the supervisory board of the Union Investment Institutional GmbH, a fellow at the Center for Financial Studies in Frankfurt and was a member of the Academic Advisory Board of the Deutsche Bundesbank and of the review board for "Economics" at the German Research Foundation (DFG).

After studying at the Technical University Berlin and the University of Sussex in England, he gained his PhD under Hyman Minsky, Edward Greenberg and Laurence H. Meyer at Washington University in the USA and most recently lectured in New York (1987-1994) and in Kiel (1994-2003). He was awarded the Fulbright (2004/05) and Theodor-Heuss honorary professorship (2012) in the USA.

The main focus of his research includes methodological and empirical financial market research, risk and portfolio management, regulation and the interaction between the financial and real economies.