"The goal of science has always been to reduce the complexity of the world to simple rules." This quote comes from Benoît B. Mandelbrot, who was one of the few people to imbue mathematics with a new aesthetic and simplicity. Although his bestseller 'The Fractal Geometry of Nature' was more akin to the book of an artist, it also yielded extensive findings for research into risk.

"Clouds are not spheres"

The life of this scientist, w ho was born in Warsaw in 1924, was dominated by a single question: how can we measure patterns that occur in nature but which simply cannot be understood by using the classical mathematics of perfect geometrical forms? "Clouds are not spheres, mountains are not cones, coastlines are not circles, and bark is not smooth, nor does lightning travel in a straight line," Mandelbrot once remarked. But what shape is a mountain, a coastline or a river? What form does a cloud or a flame exhibit? And how can the volatility of prices be represented in a figurative sense?

From a very early age he developed the extraordinary ability to solve complex mathematical problems by using geometrical visualisation. This all happened during turbulent times: Mandelbrot and his Jewish-Lithuanian family emigrated to Paris in 1936 before the outbreak of the Second World War. These experiences helped to shape his mathematical talent, which "I developed by observing plants and trees while we were fleeing." In 1944 he passed the entrance exam for the École Polytechnique in Paris with flying colours. "The problem that we were set was easy to solve if you used spherical coordinates instead of Cartesian ones. But I was the only candidate in the whole of France who was able to see that at the time."

Mandelbrot began his career in the United States in the late 1950s, working in the research department of the Thomas J. Watson Research Center at IBM. Looking back on a career spanning a total of 35 years at the computer giant, Mandelbrot – who eventually became a professor of mathematics – described this period as a 'golden age': "I found fulfilment in seemingly unrelated areas that did not follow any usual pattern and were therefore widely regarded as bizarre."

He was not universally understood. Throughout his life, Benoît Mandelbrot was seen as something of a maverick in the world of mathematics. He remained an unorthodox lone voice, a contrarian and a non-conformist, attaching little importance to formal theorems and proof.

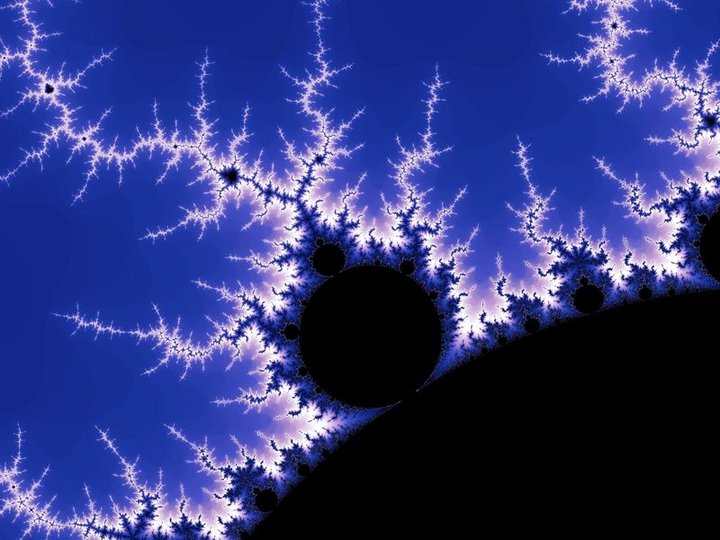

The Mandelbrot set

The Mandelbrot set

Even when he was growing up, Mandelbrot had admired Johannes Kepler, the German natural philosopher, mathematician, astronomer and astrologist. Kepler had used his interdisciplinary knowledge to devise three laws of planetary motion. As a young person, Benoît B. Mandelbrot dreamed of discovering something of similarly far-reaching importance. And he succeeded in doing just that when he developed the Mandelbrot set that is named after him. This set represents a pattern that can be used to calculate and visualise the roughness repeatedly occurring in nature as fractals. This happened in 1978 with the computer animation that became known as fractals, and these most intricate of geometric shapes described by the Mandelbrot set show that fractals and roughness – despite their many differences – reveal a few common characteristics.

If you zoom in and look more closely, you can see how the same smaller and smaller intricate shapes and patterns are successively nested inside each other and repeat infi nitely. The contour of a section of a fractal – no matter how small – will always look like a coastline. The fractal dimension is a ratio introduced by Mandelbrot which, for the first time, enabled the roughness and complexity of shapes – and even of non-linear events – to be described in quantitative terms. The peculiar thing about the intricate and complex shapes and patterns of fractals is that the underlying equation is anything but complicated for mathematicians: f(z) = zn2 + c. The Mandelbrot set 'M' is the set of all complex numbers 'c' for which the recursively defined sequence of complex numbers z0, z1, z2, … with the formation law zn+1 := zn2 + c and the initial condition z0 := 0 remains bounded, i.e. the amount of the sequence members does not grow beyond all limits.

Markets between risk, reward and ruin

Nowadays these findings are used in areas such as medicine, geosciences, seismology, image processing and special effects in cinematography. But the financial services industry has also been able to learn lessons from these find ings: if market participants had listened to Benoît B. Mandelbrot more often in recent decades, they probably would not have been so frequently caught off-guard by turbulent events. The inventor of fractal geometry compared the actors in financial markets with sailors. If these seafarers build a ship, they are not thinking about when exactly the next storm will be coming. They build their ship in such a way that it is sufficiently robust to withstand any conceivable storm. Financial market players, on the other hand – according to Mandelbrot – behave as if it were sunny every day. They calculate their ability to sustain risk based on a confidence level of 99 per cent or even 99.5 per cent, thereby ignoring the extreme events ('fat tails') that will sink the ship during a storm.

Mandelbrot never tired of repeatedly pointing out that the models used in practice systematically underestimate the true risks. He considered financial market theory to be a 'phoney science', believing that market gains and losses were determined by extreme events rather than by 'normal' price fluctuations. He proved that financial market price volatility could be described not by normal distribution but by Lévy distribution, which in theory – like the Mandelbrot set – exhibits infinite variance.

On the other hand, Gaussian distribution – the probability function widely established up to that point – regularly caused statisticians, climate scientists and capital market participants to fall into the same trap: they assumed that probabilities exhibit a bell-curve distribution and that the larger the deviations from a norm are, the less frequently they occur. And this was where they often went wrong, as Benoît B. Mandelbrot explained more than two years before the great fi nancial crisis – at the first risk management conference held by Union Investment in 2006. "The stock market crash of 19 October 1987 should never have happened," was Mandelbrot's view. According to calculations based on normal distribution, the probability of a one-day loss of almost 30 per cent on the Dow Jones was 1 to 1050 – a one followed by 50 zeros.

As far as the normal-distribution assumption was concerned, Mandelbrot was also critical of the widely used risk metric 'Value at Risk'. "Don't make me laugh. You believe that Value at Risk can quantify the potential risk? … If you look at how the risk of various financial products is measured, you will find that virtually all evaluations are based on the assumption of normal distribution. That is why risk is systematically underestimated. I hope that my theory of fractals will one day be as easy to use as normal distribution. Then you will see that the risk is actually much greater." Mandelbrot was convinced that most risk theoreticians had been heading down the wrong path.

"My entire life has been spent studying risk," was his assessment. Benoît B. Mandelbrot gave his final lecture in the spring of 2010, concluding with the words: "Bottomless wonders spring from simple rules, which are repeated without end – again and again." The father of the Mandelbrot set and fractal theory died in Cambridge, Massachusetts, in the United States on 14 October 2010. He opened our eyes to the fact that fractals form the core of life that, behind the apparent chaos of roughness, an impressive order exists. Thanks to his fractal geometry we can now understand the Book of Nature a little better.

Author:

Frank Romeike, born 1968, is the managing director and founder of RiskNET – a risk management portal – and was previously chief risk officer at IBM. He studied economics, psychology and mathematics in Germany and the United Kingdom. He is an adjunct professor of stochastics and risk management at various universities.

[Source: Union Investment: The Measurement of Risk, www.themeasurementofrisk.com]