To interpret insights from the field of neuroeconomics for other disciplines or applications in the domain of financial choices [for a short overview: see Häusler and Weber, 2015], it is important to understand how financial risk taking is measured in a neuroscientific setting. Especially individuals with a private or professional interest in behavioral finance often take part in neuroeconomic studies to not only aid the research, but to also get a glimpse and a personal experience of the approaches used. Here we provide a short overview of the major settings. We are first going to describe, using a recently performed experiment in our laboratory, what such a study procedure can entail. Afterwards, an overview of different tasks used to measure financial risk taking will be provided and the article will conclude with an outlook and ideas for future studies.

Performing a neuroscientific study – a short overview

As in all other kinds of scientific studies, neuroscientific studies start off with the development of a specific research question, followed by the preparation of the appropriate experiments necessary to test the relevant hypotheses. Once the experiments have been created, pre-tested, and approved by the ethics committee of our university, the participants are recruited via an in-house database, advertisements, or recruitment agencies. Here, in addition to specific criteria for the study, general exclusion criteria for MRI scanners apply and include aspects such as medical or metal implants, claustrophobia, and certain pharmaceutical drugs.

On the day of the experiment, the participant undergoes a thorough preparatory talk during which another medical screening takes place and any questions regarding the experiment are answered (Figure 01, part A). Before starting with the brain measurements, the participant completes a few training sequences of the specific experiment outside of the scanner (Figure 01, part B). Afterwards, the experimenter asks the participant again about any metal in the pockets or on the body, places him/her on the magnetic resonance imaging (MRI) table, and gives him/her ear protection, usually in the form of earplugs. Next, a head coil is placed directly above the subject’s head and a set of goggles or a mirror reflecting a screen located behind the scanner is attached in front of the participant’s eyes. These visual accessories are then adjusted to correct for any visual issues such as bad eyesight. Once the participant sees clearly, response grips with the relevant choice buttons are placed in the participant’s hands and the participant is slowly navigated into the MRI scanner (Figure 01, part C).

During the time in the scanner, the participant always has the option of pressing an alarm button, which is placed on the subject’s chest. Additionally, the experimenter is constantly observing the participant through a window from the adjacent control room and talks to him during breaks using an intercom. During the time in the scanner, the participant undergoes a short structural measurement of the brain (about 8 minutes), followed by the actual experimental task (commonly called a paradigm) and other measurements of interest. Depending on the length of the paradigm and the different types of additional measurements, this can take anywhere from 15 minutes to 1.5 hours, depending on the research question. During this paradigm (three of them are going to be explained in the following paragraph), the participant is asked to make financially risky or safe choices using a given initial endowment. By making correct/incorrect choices, the participant is able to increase/decrease his endowment, which is paid out after the experiment. Following the scanning, the participant is guided out of the scanner into another room and undergoes further psychological testing regarding for example intelligence and personality facets (Figure 01, part D). Finally, the participation fee and any money won during the financial task are transferred to the participant’s bank account.

Figure 01: Experimental procedure; A. Preparatory talk (~2min.) B. Training (~15min.) C. Brain scanning during the financial decisions (~25min. bis 1h20min.) D. IQ and personality testing (~1h)

What tasks can be used to study financial risk taking?

Even though there are several paradigms that have been successful in measuring financial risk taking in a laboratory setting, we are only going to present three of them here. In contrast to a lot of behavioral setups, in functional MRI paradigms it is important to have repeated measures of a certain behavior or mental state. This is due to the low signal-to-noise ratio and can thereby strongly influence the way an experiment is set up – as opposed to a lot of single-shot experiments that are used in behavioral economics. An established but more abstract paradigm is the Balloon Analog Risk Task (BART, Figure 02, part A), which was first presented almost two decades ago by Lejuez et al. [Lejuez et al. 2002] and has been used many times ever since. In this task, participants are asked to choose between inflating or not inflating a balloon. Opting for the inflation can result in a financial value increase or in the popping of the balloon and thus the loss of all the accrued money during that trial. Just as with a real balloon, the chance of the balloon exploding increases with the amount of inflation. Choosing not to inflatee the balloon results in collecting all of the accrued money and a fresh start with a new non-inflated balloon. In this task, the average "pumps per balloon” represent the individual level of risk taking.

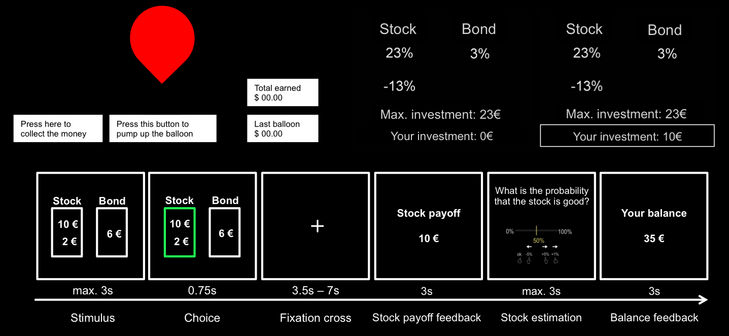

Being less abstract and applying to more commonly used financial risk terms, two other paradigms named the stock allocation task (Figure 02, part B) and the stock exchange paradigm (Figure 02, part C) have been invented. In the stock allocation task (Figure 02, part B), subjects are able to invest up to 23 EUR into a risky asset (the stock) with a 50/50 chance of receiving either a positive or negative interest on the invested money, with the rest going into a safe asset (the bond). The average amount of money invested into the stock represents the individual level of financial risk taking, and the feedback of money won or lost is given to the participant only after the whole experiment is done in order to avoid any learning mechanism. Finally, the stock exchange paradigm (Figure 02, part C) is a very recently invented financial risk taking paradigm in which subjects are again asked to opt for either a risky (stock) or a safe (bond) asset. The ratio of stock to bond choices is taken as a measurement of financial risk taking. Besides being able to measure additional aspects such as learning and probability estimation using this more complex task, the brain activation during the risky versus the safe choice is highly interesting, since it provides neuroscientific information for us researchers on why individuals differ in their risk taking actions.

Figure 02: Sample trials from various financial risk taking experiments. A. Balloon Analog Risk Task (BART, adapted from Lejuez et al. 2002) B. Stock allocation task C. Stock exchange paradigm.

Outlook

Despite the great amount of insights that we are currently gaining from the mentioned paradigms, the neuroeconomic community is well aware that financial risk taking in the "real world” can be quite different and much more multi-facetted. Real-life financial decisions such as opting for a bond or investing in a stock are not simply made with the push of a single button after receiving simplified risk information on a screen. However, our approach is that in order to understand a complex decision such as a stock purchase, it has to be broken down to its core components to consecutively build on the results. We also know that using the gold-standard method of MRI has the clear drawback of having the studies only taking place in very controlled MRI laboratory settings. More mobile brain measuring systems such as near-infrared spectroscopy (NIRS) and electroencephalography (EEG) provide some alternatives, but their poor spatial resolution limits their application. Henceforth, one of the future challenges will be to integrate more realistic settings to neuroimaging experiments. These could include real-life financial decisions taking place inside the scanner in e.g. a virtual reality environment. One idea would be to get financial advice through a virtual reality meeting with a financial advisor and having to opt for the risky or safe option following such a meeting, all while lying in the scanner and having your brain activation recorded. This could reveal how and why different approaches of financial advice could alter the resulting financial decision of the client. With modern technology and new inventions making these experiments possible, we as neuroeconomists are excited for the times ahead.

Literature

- Häusler, AN, Weber, B [2015]: Implications from neuroeconomics for the understanding of investment behavior. Frankfurt Institute for Risk Management and Regulation (FIRM) Yearbook 2015:86-87.

- Kuhnen, CM [2015]: Asymmetric learning from financial information. The Journal of Finance 70(5):2029-2062.

- Kuhnen, CM, Chiao, J [2009]: Genetic determinants of financial risk taking. Plos One 4(2):e4362

- Lejuez, CW, Read, JP, Kahler, CW, Richards, JB, Ramsey, SE, Stuart, GL, Strong, DR, Brown, RA [2002]: Evaluation of a behavioral measure of risk taking: the Balloon Ana- logue Risk Task BART. Journal of Experimental Psychology: Applied 8(2):75–84.

Authors

Professor Dr. Bernd Weber, Heisenberg Professor, Board of Directors, Center for Economics and Neuroscience, University of Bonn

Alexander Niklas Häusler, PhD Student, Center for Economics and Neuroscience, University of Bonn

[The article was published first in FIRM Yearbook 2017. Download the FIRM Yearbook 2017 underwww.firm.fm]