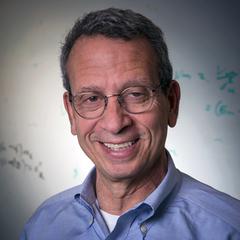

The Center for Financial Studies (CFS) has awarded the Deutsche Bank Prize in Financial Economics 2015 to Stephen A. Ross. Jury Chairman and CFS Director Jan Pieter Krahnen explained the decision of the international Jury: "The Jury has chosen Professor Stephen A. Ross for his groundwork and fundamental contributions to the analytical development of financial economics. For more than 25 years major models developed by him have marked the economic world. His models relate to the theory of asset pricing, the analysis of the term structure of interest rates, understanding option prices, and the basic structure of the principal-agent problem. The work of Stephen A. Ross has shaped today’s thinking in financial innovation, practice, and policy."

The academic prize is sponsored by the Deutsche Bank Donation Fund and carries an endowment of €50,000. The CFS awards the prize biannually in partnership with Goethe University Frankfurt and in 2015 for the sixth time. It will be presented to Stephen A. Ross as part of an academic symposium in Frankfurt on 24 September 2015. The Deutsche Bank Prize in Financial Economics honors internationally renowned economic researchers whose work has a marked influence on research concerning questions of financial economics and macroeconomics, and has led to fundamental advances in economic theory and practice.

An outstanding scientist with the ability to make complex theories tangible for broad audiences

His wide range of research interests include the economics of uncertainty, corporate finance, decision theory, and financial econometrics. Renowned for his fundamental contribution to modern financial economics, Ross’ models have changed and advanced economic practice profoundly. They are widely applied and standards in academia and the financial industry.

Stephen A. Ross is the inventor of the Arbitrage Pricing Theory, a cornerstone of modern asset pricing theory, and the Theory of Agency, which is omnipresent not just in corporate finance but also in many other spheres of economics. Furthermore, he is the co-creator of Risk-Neutral Pricing and of the Binomial Model for Pricing Derivatives. His work has been central for the development and the empirical analysis of term structure models. He co-authored the Econometrica paper A Theory of the Term Structure of Interest Rates in 1985, which remains one of the most crucial contributions on the topic to this date.

In addition, Ross’ Recovery Theory has opened up huge potential for the analysis of household subjective expectations, rationality and financial literacy, but also financial advice. His theories provide standards for pricing in major securities trading firms, useful for retirement accounts and for new financial products that may allow households to insure a wider range of risks.

Stephen A. Ross is the Franco Modigliani Professor of Financial Economics at the MIT (Massachusetts Institute of Technology) Sloan School of Management. Previously, he was the Sterling Professor of Economics and Finance at Yale University for 13 years and a Professor for Economics and Finance at the Wharton School of the University of Pennsylvania from 1975 to 1977. Ross is a fellow of the Econometric Society and a member of the American Academy of Arts and Sciences, serving as an associate editor of several economics and finance journals. In 1988, he was president of the American Finance Association.

Stephen A. Ross is the Franco Modigliani Professor of Financial Economics at the MIT (Massachusetts Institute of Technology) Sloan School of Management. Previously, he was the Sterling Professor of Economics and Finance at Yale University for 13 years and a Professor for Economics and Finance at the Wharton School of the University of Pennsylvania from 1975 to 1977. Ross is a fellow of the Econometric Society and a member of the American Academy of Arts and Sciences, serving as an associate editor of several economics and finance journals. In 1988, he was president of the American Finance Association.

Stephen A. Ross is the author of more than 100 peer-reviewed articles in economics and finance and co-author of the best-selling textbook Corporate Finance. Furthermore, he has further acted as advisor to the financial sector, major corporations, and government departments such as the U.S. Treasury, the Commerce Department, the Internal Revenue Service, and the Export-Import Bank of the United States. He holds a PhD in Economics from Harvard University.

As well as a globally recognized academic and a widely published author in finance and economics, Stephen A. Ross is a member of the American Academy of Arts and Sciences. In 1988, he led the American Finance Association as its President. Ross currently also serves as an associate editor of several economics and finance journals. He is the author of more than 100 articles in economics and finance and co-author of the best-selling textbook Corporate Finance.

The Deutsche Bank Prize in Financial Economics was awarded for the first time in 2005 to Eugene F. Fama, Nobel Laureate (2013) and Professor of Finance at the University of Chicago, for researching the concept of individual rationality in financial market behavior. In 2007 Michael Woodford, Professor of Political Economy at Columbia University, received the prize for his groundbreaking redefinition of monetary analysis. In 2009 Robert J. Shiller, Nobel Laureate (2013), Professor of Economics at Yale University and Professor of Finance at Yale School of Management, received the prize for his constructive challenge of rationality and promotion of behavioral considerations. Kenneth Rogoff, Professor of Economics and Professor of Public Policy at Harvard University in Cambridge, USA, received the prize in 2011 for his analysis of financial crises. In 2013, the prize went to Raghuram Rajan, Governor of the Reserve Bank of India (RBI) and former Chief Economist at the International Monetary Fund (IMF), for his highly influential contributions in a remarkably broad range of financial economic fields that are crucial to the development of economies worldwide.