After a surprisingly good start to 2014, the German economy cooled noticeably in the course of the year. This was mainly due to the slowing of growth in key export markets and higher uncertainties on the back of geopolitical crises.

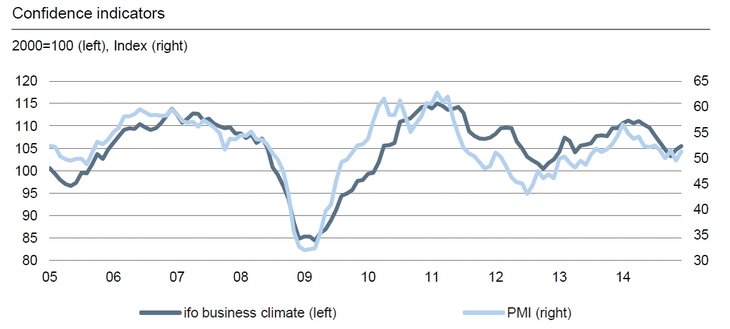

By contrast, the domestic economy, underpinned by a robust labour market, continued to post solid performance and was again by far the main driver of growth. Following a weak winter half in 2014/15 the economy looks likely to regain its footing as 2015 progresses. The ifo’s rise in November and December points in this direction. However, sluggish performance at the turn of the year means growth will probably average only 1% in 2015 after 1.4% in 2014.

It is encouraging, however, that private consumption should remain a major pillar of growth, whereas net exports are likely to have a neutral impact. Nonetheless, signs are increasing that some – in our opinion misguided – economic policy moves (such as the introduction of a nationwide minimum wage as well as an enhanced pensions package) are weighing on the labour market and thus on consumption. Employment looks set to increase at a much slower pace than in 2014 and unemployment set to rise in the second half of the year.

While residential construction is still in good shape we expect little growth stimulus from investment in machinery and equipment. The chances of public budgets ending the year 2014 with a borderline surplus are fraught with risk. Given a weakening of cyclical activity and the costs of economic policy measures, we expect the general government budget to be slightly in deficit in 2015.

Sources: ifo, Markit

Economic performance 2014: Impacted by capricious weather, calendar effects and geopolitical developments

The German economy boomed into 2014 with gross domestic product (GDP) notching up real growth of 0.8% (on the previous quarter) in Q1. Since then, however, this growth has weakened appreciably. While this sounds quite straightforward at first, it actually only poorly describes the growth dynamics of 2014 in the light of substantial weather-related distortions and special factors, such as calendar effects. Some 60% of the strong growth in the first quarter was attributable to the extreme jump in construction investment brought on by the mild weather. While investment in construction had fallen by 0.5% on average in the first quarter of each of the previous ten years, the reading for the first three months of 2014 was up 4.2%. As a consequence there was no revival of construction activity in spring as usual. The construction investment correction in Q2 (-3.9%) was one of the major reasons for the slight contraction of the German economy in that quarter.

Furthermore, the timing of the statutory holidays and school holidays as well as the shifting of factory shutdown periods (in the auto industry, for instance) during the summer half-year triggered further distortions that statistical adjustment methods were unable to strip out appropriately, so it was virtually impossible to shed satisfactory light on the actually underlying growth dynamics.

Besides these more technical factors economic activity was driven by two international developments in particular in 2014. One of these was the Russia-Ukraine conflict which led to the Western countries' imposition of heavy sanctions on Russia, a noticeable clouding of sentiment in industry and a severe downturn in German exports to Russia. The other was the increase in uncertainty over the economic recovery of the eurozone, which had started to weaken at about mid-year. This was a further blow to German investment activity, which had already been staggering under sluggish world trade. As an example, investment in machinery and equipment fell again from about mid-2014 after a tentative recovery at the start of the year.

Nonetheless, the German economy expanded by 1.4% in 2014 owing to the favourable starting position created by the robust growth in the first quarter. The latter was mainly due to a healthy increase in private consumption and construction investment, whereas the contribution of net exports to GDP growth was likely moderate. Germany thus again posted the highest GDP growth among the major euro countries.

Recovery expected on heels of sluggish 2014/15 winter half

Given the months of continually clouded business sentiment, disappointing order intake (from the domestic side in particular) and the recent drop in industrial production to below the year-earlier level, we expect weak economic performance in the winter half. Even though we look for a subsequent recovery of growth – we forecast solid quarterly rates of 0.3% on average – GDP expansion looks set to remain below the year-earlier reading on average in 2015 at 1% on account of the unfavourable starting position. It follows that the German economy will not be able to exhaust its full growth potential of 1.2% until 2016.

German economy (still) in good form

The weaker performance in the current year is mainly of a cyclical nature. The German economy is actually still in pretty good shape, highly innovative and competitive. Furthermore, there is no significant near-term need for budget consolidation in the public or private sector, and the unusually good labour market performance, by international standards, points to still relatively healthy structures. Even Germany's infrastructure – increasingly the subject of critical debate – continues to achieve top rankings in international comparisons. However, several positive policy reform moves that were implemented some ten years ago have already been rolled back or are in some cases at risk of being rolled back. Not least the steadily approaching demographic challenges point to the necessity of a reform agenda 2030.