People love stories and simple truths. The "halo effect" has already been extensively researched in the field of behavioural economics. In everyday business life in particular, this effect ensures that we fall prey to systematic misjudgements.

How else can it be explained that the world champion coach of the German national football team, Joachim Löw, was seen as innovative, empathetic, flexible and decisive until the beginning of June 2018 and less than four weeks later as old-fashioned, disorientated, rigid and not decisive enough? In between was the 2018 World Cup, in which the German team, the reigning football world champions, were eliminated in the preliminary round without a sound.

The name Joachim Löw could also be replaced by Julian Nagelsmann in the current context. The latter was long hailed as the world's greatest coaching talent. After two embarrassing defeats for the German national team in recent days, the first swansong has already been sounded.

In football, the "curse of the Nutella boys" around Benjamin Lauth, Kevin Kuranyi, Arne Friedrich, Andreas Hinkel & Co. was long rumoured. It was rumoured that the promising young DFB footballers were cursed after their careers stuttered when they first started advertising the sweet nut cream.

Forbes cover as a curse?

Such a curse was not only experienced by the "Nutella boys", but also by the cover faces and cover companies of Forbes magazine. The following Fig. 01 shows exemplary "role models" such as Elizabeth Holmes, Sam Bankman-Fried, Silicon Valley Bank and Changpeng Zhao.

![Fig. 01: Forbes cover with "role models" [Source: Forbes] Fig. 01: Forbes cover with "role models" [Source: Forbes]](/fileadmin/_processed_/c/1/csm_Abb-01_Glaser_20231124_9dc0dd3e67.jpg) Fig. 01: Forbes cover with "role models" [Source: Forbes]

Fig. 01: Forbes cover with "role models" [Source: Forbes]

Classification of the people and companies mentioned:

- As the founder of Theranos, Elizabeth Holmes was long regarded as a US biotech pioneer. She promised to revolutionise blood tests and claimed that just a few drops of blood would be enough to carry out complex tests. Her company was valued at nine billion US dollars in financing rounds before it turned out that the technology did not work and Holmes was found guilty of investment fraud in November 2022 and sentenced to eleven years in prison.

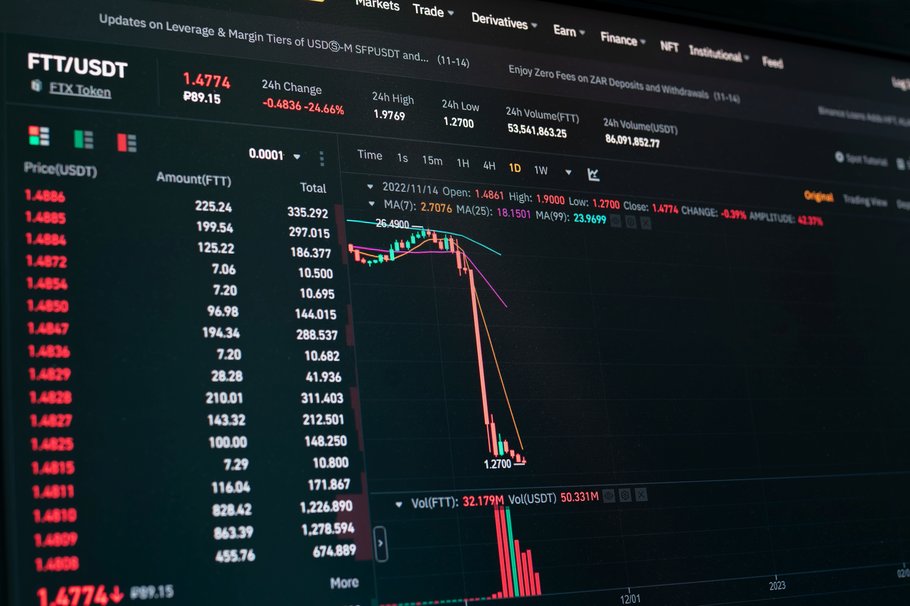

- Sam Bankman-Fried was one of the crypto pioneers with his platform FTX. At its peak, it had around eight million customers, including hundreds of thousands in Germany and Europe. He embezzled customer funds and caused losses of eight to ten billion US dollars. SBF, as he was known, was found guilty on all counts by the New York court. Although the exact sentence will not be announced until March 2024, experts expect at least 10 years' imprisonment. The "golden boy of the crypto world" was renamed "Scam Bankman Fraud" by Stanford professor Martin Kulldorff on Twitter.

- Silicon Valley Bank (SVB) also had very lofty ambitions. However, as it turned out, the bank neglected any form of risk management for far too long and had not even implemented the simplest security mechanisms. Even the "golden balance sheet rule" was criminally disregarded, leading to a domino effect in March 2023 with the failure of the long-hyped bank.

- A few days ago, the Forbes "Hall of Fail" gained another new member. Binance founder and CEO Changpeng Zhao is another crypto pioneer who has failed miserably. He resigned with immediate effect and pleaded guilty to money laundering. In addition, Binance says it will pay around 4.3 billion US dollars in fines.

Cheerleader effect

The big problem is often that we use our stories and explanations too much to make predictions. This makes our explanations and subjective perceptions appear more real and objective than they actually are. It always becomes particularly critical when negative developments are overshadowed for too long by certain characteristics that are perceived as positive. This was probably the case in all the examples mentioned.

An illustrative example is the so-called "cheerleader effect", which states that a single person appears more attractive in a group of people than on their own. The attractiveness of the cheerleading group as a whole outshines the actual attractiveness of the individual members. This cognitive distortion was picked up on in the US TV series "How I Met Your Mother" when the character Barney Stinson explained the effect to his friends in a bar: a group of women who had just entered the bar looked more attractive as a whole than when the women were viewed individually (season 4, episode 7, episode "The Non-Father's Day"). Because when the camera zoomed in on the individual women, you suddenly saw misaligned teeth, piercings all over their faces and oversized eyebrows. The two US psychologists Drew Walker and Edward Vul were able to empirically prove this effect in five experiments with over 130 test subjects.

The luck factor in risk management

critical distance should always be maintained not only with Forbes covers, but also with best practices and blueprints of highly successful companies. For example, the 2002 Nobel Prize winner in Economics, Daniel Kahneman, explains that bestsellers such as "Always Successful" (originally: Built to Last) or "In Search of Excellence" (originally: In Search of Excellence) are also based on the halo effect.

This is because when analysing the companies in which one was more successful than the other, no or only a minor role is attributed to chance and luck. Instead, highly consistent patterns are developed on the basis of which "a visionary company can be built".

This is also supported by the fact that the quality of management teams and management practices has not (yet) been empirically proven. In fact, the lead of the outstanding companies analysed in the study over the less successful companies in terms of profitability and return on shares has fallen to practically zero. The same applied to the companies in the book "In Search of Excellence". This can be seen in companies such as Citigroup, Hewlett Packard, Motorola and Sony, which are still active on the market, but no longer outperform all their competitors.

To-dos for risk management

Risk management needs stories. However, these must be as objectively comprehensible and well-founded as possible. On the one hand, this ensures that the core message is conveyed clearly and simply and, on the other, that no illusions become part of risk management.

- Simple rules and correlations

Despite all the euphoria and success stories, it is regularly the simple rules and fundamental correlations that cannot be (permanently) overridden. Rather, the simple correlations should also be used appropriately for validation in all risk management decisions. Issues such as the "golden balance sheet rule" or risk-bearing capacity and capital planning will never become obsolete.

Only through good risk management and a clear moral compass can the continued existence and development of a company be positively shaped. This was very clearly demonstrated by the four examples of former superstars in the business cosmos. Deficiencies in risk management quickly mean a considerable risk in management!

The current political discussion about the decision of the Federal Constitutional Court, according to which the 60 billion euros to combat the coronavirus crisis cannot simply be used for climate protection, could also be placed in this context. This was quickly dismissed as a "black swan" because such a decision "could not have been foreseen" and "it has always been done this way in the past". This is all wrong. At most, this was a "dirty" white swan. The speech by CDU politician Mathias Middelberg in October 2022 alone makes it clear that there were already at least "weak signals" that such a situation could arise. A good risk manager would have at least carried out a solid stress test on this basis. Even simple basic rules would have made it clear that a committed loan cannot simply be used for other expenses. The house builder may not simply use his promised loan for the house financing to finance his trip around the world. It is not uncommon for "common sense" to help recognise such undesirable developments. It is rather astonishing that it takes the highest German court to point this out. - Facts instead of fantasy

What sounds simple is often very difficult: focus on facts instead of (too much) fantasy. Especially with innovative products and activities in new markets, a large portion of euphoria and fantasy is automatically involved when future expectations are projected. Here, too, it is important to avoid systematic misjudgements and distortions.

In particular, the prospects of success are systematically overestimated. This can be seen, for example, in the survival fallacy. This goes back to the Second World War. The British sent bombers across the English Channel almost daily. An endeavour from which not all pilots returned alive. They analysed the bullet holes of the returning aircraft and reinforced the armour in these places. However, this did not increase the survival rate and it was assumed that the armour might be too heavy, making the aircraft difficult to manoeuvre. It was the Hungarian mathematician Abraham Wald who finally debunked the "survival fallacy" and came up with what at first glance appeared to be a relatively strange suggestion: the planes should be armoured where there were no bullet holes. This was because hits in these areas (namely the 1.5 x 2 metre area where the tank was located) caused the aircraft that had not returned to crash. And conversely, the returned machines only had bullet holes where they could hardly cause any damage.

Following Abraham Wald, it is often the case in risk management that only an unclouded view of the facts allows the risk situation to be clearly presented and objectively assessed (see the excellent book Factfulness by the Swedish physician and statistician Hans Rosling). Overly high popularity ratings of companies and company founders can quickly obscure this unclouded view. - The steeper the hierarchies, the higher the risk

In many major corporate bankruptcies and loss events in the past, one pattern emerged time and again: untouchable egomaniacs were able to do as they pleased without any real dual control principle and without a strong corrective. In the Wirecard case, it was Markus Braun and Jan Marsalek, at Signa Holding it was the all-conquering René Benko and at Siilicon Valley Bank and the three other Forbes cover stars, there were also major weaknesses in internal governance.

For every risk manager and advocate of an even "power balance", the current developments surrounding OpenAI and the former and then recently reappointed CEO Sam Altman are also very interesting to see. There were accusations from the supervisory board, which complained about a lack of transparency and information and stated that the CEO's failure to communicate with the supervisory body meant that no effective control could be exercised. As a consequence, Altman was dismissed. He, in turn, returned after a revolt by staff and shareholders, after a Microsoft engagement was briefly rumoured. The Supervisory Board will probably (have to) resign as a consequence of Altman's increased power. A balanced power structure definitely looks different!

In order to recognise undesirable developments at an early stage, particularly in the case of steep hierarchies, a whistleblowing system has been enshrined in law. Such a whistleblowing system can and should help to minimise existential risks and internal fraud. However, they can never be completely prevented. - Trust is good, control is better.

The more tense and precarious the situation is, the more important the trust factor becomes. The joint press conference held by the then German Chancellor Angela Merkel and her Finance Minister Peer Steinbrück at the height of the financial crisis in October 2008, when both assured the public that savings deposits were safe, is unforgotten.

Part of good risk management is to regularly ascertain the actual risk situation for yourself. This can involve on-site visits and meetings, but also IT-supported analyses. Risk managers must not hide behind their screens, but must talk to people and familiarise themselves with the facts on site. This requires an interdisciplinary and non-ideological view of reality.

So no completely new tools and techniques are required. Rather, it is important that you become aware of the central weaknesses of your system and the vulnerability of your decisions. This is the only way to avoid major mistakes when assessing risk scenarios.

Author

Dr Christian Glaser holds a doctorate in risk management and is the managing director of a well-known financial services provider. He is also a lecturer at several universities and the author of several specialist books and numerous specialist publications in the fields of financial services, corporate governance and management, controlling and risk management.