When the United Kingdom reached a debt ratio of around 100 percent of gross domestic product in the autumn of 2022 and at the same time yields on British government bonds surged within a matter of days, it became clear that even highly developed economies do not possess unlimited fiscal risk-bearing capacity. The turmoil in the gilt market revealed how sensitive financial markets are to doubts about fiscal sustainability. Historically, the European sovereign debt crisis beginning in 2010 and the US budget crisis of the 1980s demonstrate that states – despite their power to tax – are by no means immune to losses of confidence. Against this backdrop, Pablo Hernández de Cos, General Manager of the Bank for International Settlements (BIS), analysed in his lecture "Fiscal threats in a changing global financial system" at the London School of Economics on 27 November 2025 the structural risks arising from high debt levels and the transformed architecture of global financial markets.

Public debt at historic highs

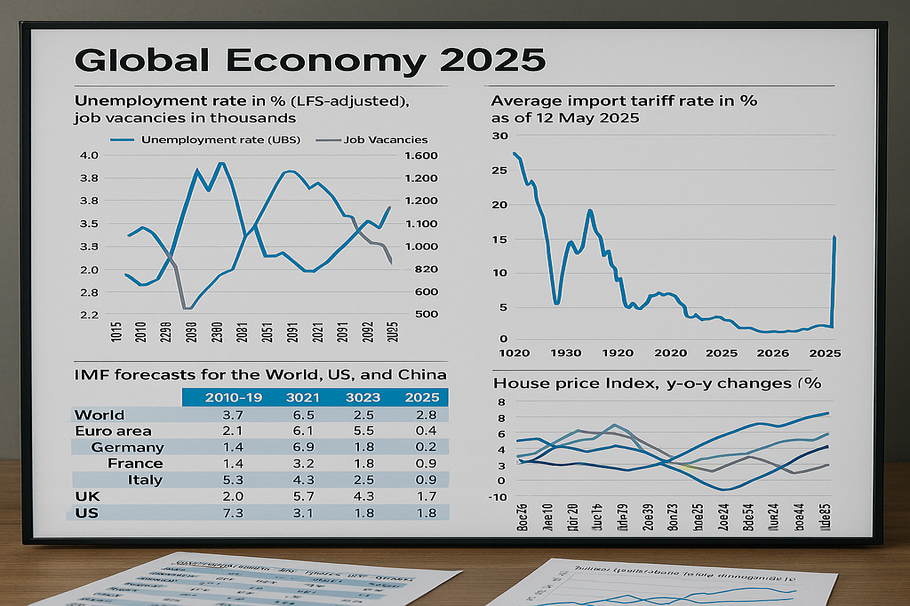

Since the Great Financial Crisis, public debt has risen steadily in many Western economies. Current projections suggest that debt ratios in advanced economies could reach nearly 120 percent of GDP on average by 2030. Taking into account demographically driven increases in pension and healthcare expenditure, as well as additional defence and climate-related investment, even significantly higher levels are conceivable by 2050. Even under moderate interest-growth differentials, this would imply a substantial long-term expansion of debt servicing burdens.

![Figure 01: Government debt and deficits in advanced economies [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025] Figure 01: Government debt and deficits in advanced economies [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]](/fileadmin/_processed_/2/0/csm_Abb-01_Cos-BIS_20260217_ea822c2d0f.png) Figure 01: Government debt and deficits in advanced economies [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]

Figure 01: Government debt and deficits in advanced economies [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]

Interest expenditure is already rising noticeably. In several OECD countries, it exceeded 4 percent of GDP in 2024. At high debt levels, rising refinancing costs can quickly have exponential effects. Historical experience shows that periods of low real interest rates do not guarantee lasting fiscal relief. Adjustments are often abrupt – particularly when investor confidence erodes.

![Figure 02: Development of interest expenditure as a percentage of GDP [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025] Figure 02: Development of interest expenditure as a percentage of GDP [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]](/fileadmin/_processed_/1/9/csm_Abb-02_Cos-BIS_20260217_8c5e4aae1b.png) Figure 02: Development of interest expenditure as a percentage of GDP [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]

Figure 02: Development of interest expenditure as a percentage of GDP [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]

The structural break: from banks to NBFIs

Alongside the expansion of public debt, the structure of financial intermediation has fundamentally changed. Following tighter regulatory requirements, banks have retreated from parts of market-based activities. Non-bank financial institutions (NBFIs) – including investment funds, pension funds, insurance companies and hedge funds – increasingly assumed the role of primary financiers of government deficits.

![Figure 03: Shift in financial intermediation from banks to NBFIs [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025] Figure 03: Shift in financial intermediation from banks to NBFIs [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]](/fileadmin/_processed_/6/2/csm_Abb-03_Cos-BIS_20260217_2d8259251e.png) Figure 03: Shift in financial intermediation from banks to NBFIs [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]

Figure 03: Shift in financial intermediation from banks to NBFIs [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]

Hedge funds in particular expanded their presence in sovereign bond markets, often through highly leveraged strategies. These frequently rely on so-called relative-value approaches, exploiting small price differences between cash and futures markets. Financing typically occurs via the repo market – in some cases with very low or even zero haircuts, enabling high leverage ratios.

![Figure 04: Hedge fund exposures and repo financing [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025] Figure 04: Hedge fund exposures and repo financing [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]](/fileadmin/_processed_/6/2/csm_Abb-03_Cos-BIS_20260217_2d8259251e.png) Figure 04: Hedge fund exposures and repo financing [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]

Figure 04: Hedge fund exposures and repo financing [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]

At the same time, the market for foreign exchange swaps has grown to around USD 130 trillion. A large share of these contracts has maturities of less than one year. Long-term investments are thus hedged through short-term dollar funding – a structure that entails significant refinancing risks under stress conditions.

![Figure 05: Structure and maturities of FX swaps [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025] Figure 05: Structure and maturities of FX swaps [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]](/fileadmin/_processed_/d/b/csm_Abb-05_Cos-BIS_20260217_4d79e4ee74.png) Figure 05: Structure and maturities of FX swaps [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]

Figure 05: Structure and maturities of FX swaps [Source: Lecture by Pablo Hernández de Cos, London School of Economics, 27 November 2025]

New risks: snapback effects and global dollar shortages

The altered market structure increases the likelihood of non-linear yield spikes. Three central transmission channels stand out: first, leveraged hedge fund positions may be liquidated abruptly following margin calls; second, FX swaps create maturity transformation risk; third, tight interconnections between repo and FX swap markets mean that stress in one segment can quickly trigger global dollar liquidity shortages.

These dynamics demonstrate that fiscal sustainability is not merely a matter of primary balances and interest-growth differentials. What matters is not only the fiscal metric itself but also the actual loss-absorbing and refinancing capacity of financial intermediaries holding large volumes of sovereign debt. If their balance sheet buffers, liquidity reserves or risk budgets are overstretched by valuation losses, margin calls or refinancing constraints, abrupt portfolio adjustments, forced sales and sharp yield increases may occur – much earlier and more forcefully than traditional fiscal sustainability models would suggest.

Conclusion: the role of sovereign risk management

The analysis calls for an integrated policy approach. From a supervisory perspective, excessive leverage should be curtailed and minimum haircuts in repo markets introduced. Greater use of central clearing could enhance transparency and resilience.

In monetary policy, price stability remains the central objective. Inflation surprises may temporarily reduce debt ratios but undermine long-term confidence and raise risk premia. Central bank swap lines remain essential in times of crisis to stabilise global dollar liquidity.

From a fiscal perspective, credible, growth-friendly consolidation is required. Structural reforms in labour and product markets, along with investment in infrastructure and innovation, can help ensure the long-term sustainability of public finances.

At the same time, the classical triad of supervision, monetary and fiscal policy is insufficient if states do not systematically manage their own risk-bearing capacity. High debt ratios reflect accumulated exposures to interest rate, refinancing and currency risks, implicit guarantees and contingent liabilities, as well as shocks from financial crises, pandemics or geopolitical conflicts. Without integrated sovereign risk management, fiscal policy remains reactive rather than forward-looking.

A modern sovereign risk management framework should include comprehensive risk assessment, macro-fiscal stress testing, active debt portfolio management, the build-up of fiscal buffers and strong institutional governance. Only through such measures can states enhance resilience and prevent high debt levels combined with fragile market structures from escalating into abrupt confidence crises.

Key findings

- Historically high public debt increases systemic vulnerability.

- NBFIs increasingly dominate sovereign bond markets.

- Repo and FX swap markets enable high leverage.

- Short-term dollar funding creates rollover risk.

- Non-linear yield spikes ("snapbacks") are more likely.

- Coordinated fiscal, monetary and prudential action is required.

Further references

- Dalio, R. (2025): How Countries Go Broke: The Big Cycle, Simon & Schuster, New York 2025.

- de Cos, Pablo Hernández (2025): Fiscal threats in a changing global financial System, Lecture by Pablo Hernández de Cos, Bank for International Settlements, London School of Economics, London, 27. November 2025.

- Panizza, U./Sturzenegger, F./Zettelmeyer, J. (2009): The Economics and Law of Sovereign Debt and Default, in: Journal of Economic Literature, Vol. 47, No. 3, September 2009, S. 651–98.

- Reinhart, C. M./Rogoff, K. S. (2009): This time is different – Eight centuries of Financial Folly, Princeton University Press, Princeton 2009.

- Reinhart, C. M./Rogoff, K. S. (2004): Serial Default and the "Paradox" of Rich-to-Poor Capital Flows, in: American Economic Review, 2004, 94(2), 5358.

- Romeike, Frank (2026): Wie Staaten bankrott gehen – Die Gesetzmäßigkeit der Risikotragfähigkeit [How countries go bankrupt – The law of risk-bearing capacity], in: ZInsO FOKUS (Zeitschrift für das gesamte Insolvenz- und Sanierungsrecht) [Journal for all aspects of insolvency and restructuring law], 29th year, 5/2026, January 29, 2026, pp. 183-195.