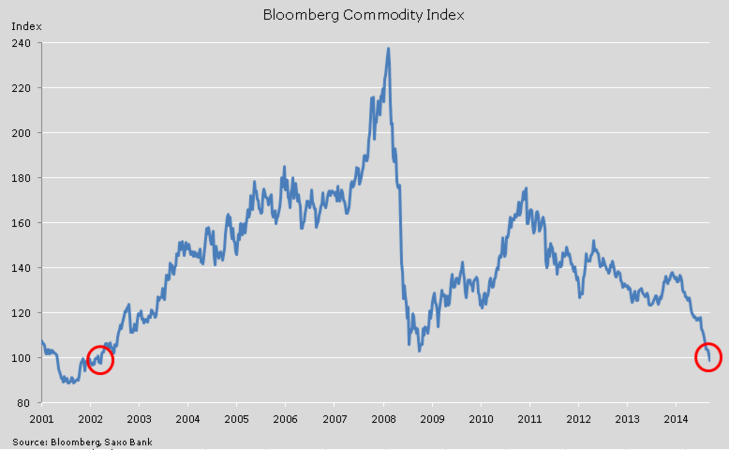

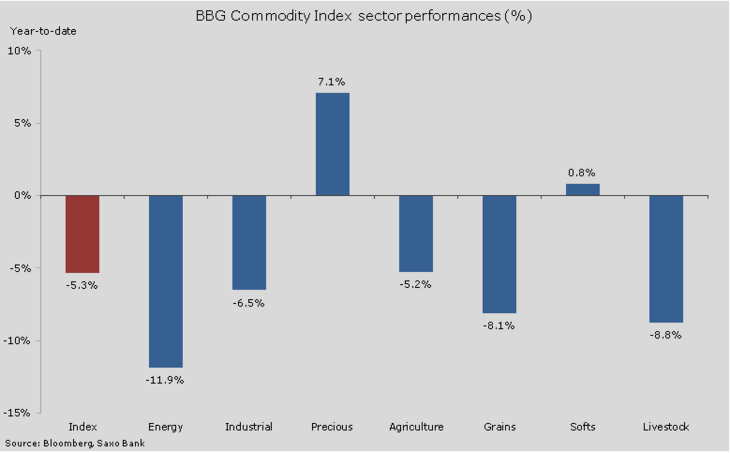

January proved to be another difficult month for commodities as the trend of falling prices amid rising supply (from crude and corn to iron ore and copper) resulted in a seventh consecutive monthly fall for the Bloomberg Commodity index.

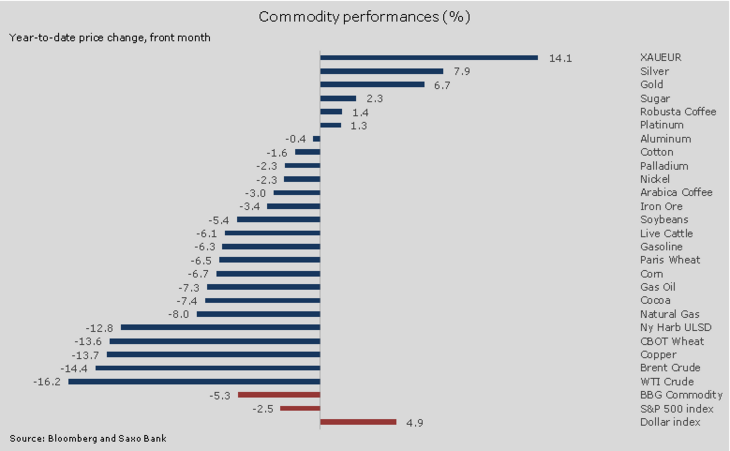

The 5% rise of the dollar against a basket of currencies also played its part in making commodities less attractive.

This index, which tracks the performance of 22 leading raw materials with a one-third exposure to each of the three main sectors of energy, metals and agriculture, has slumped to a 12.5 year low and in the process has wiped out much of the gains seen during the Chinese boom years at the beginning of this millennium.

The rout in energy was particularly strong at the beginning of the month, but for the past couple of weeks we have seen signs of resilience (apart from US natural gas which has fallen to a 28-month low on ample supply amid lower winter demand).

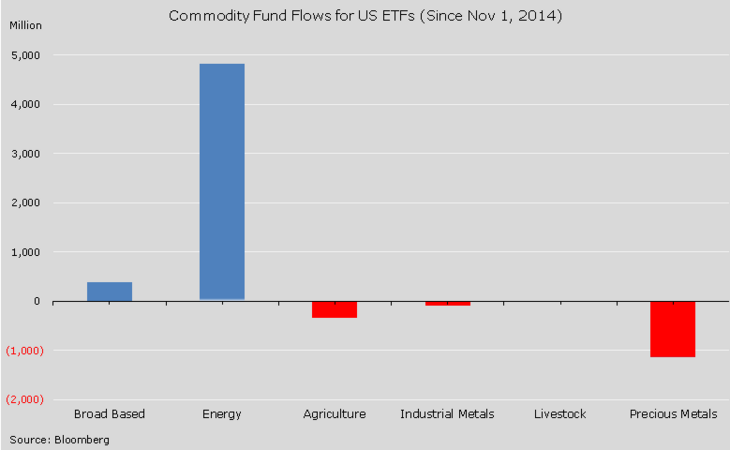

Although it is still to early to call a bottom in the market, we are at least seeing investors and traders increasingly beginning to view current levels in crude oil as a long term buying opportunity.

Precious metals ran out of supporting drivers with event risks such as the European Central Bank meeting and the Greek election now behind us. Instead, the focus returned to the US where a hawkish statement from the US Federal Open Market Committee increased speculation that it is getting ready to raise interest rates sometime this year. This was something the market had increasingly began to doubt would happen in recent weeks, considering the tightening impact from a rising dollar and weak economic outlook internationally.

The grain sector had the first losing month in four with the price of CBOT wheat falling by more than 10%. The combination of ample global supplies together with the strong dollar – especially compared with competing suppliers in Russia, Europe and Argentina – have made it difficult for US products to compete for export orders from key buyers such as Egypt and Saudi Arabia.

Some light at the end of the tunnel was seen towards the end of the month when export sales reached a four-month high which could indicate that the recent price slump had brought prices down to more competitive levels.

Industrial metals have been led lower by the rout in copper which according to Bloomberg has had its worst January in 27 years. The 14% fall this month to a 5.5 year low has made this bellwether metal one of the worst performers (together with crude oil).

The weakness has been driven by expectations that demand from China will slow and from the negative impact of a rising dollar.

Despite not seeing any sign of supply being curtailed, crude oil – both WTI and Brent – has nevertheless managed to trade within a relatively tight range for the past couple of weeks.

This is being viewed as a sign of support and investors continue to pile money into the sector, not least through exchange-traded products which have seen $2.4 billion dollars added this January (on top of $2.4 billion invested during November and December).

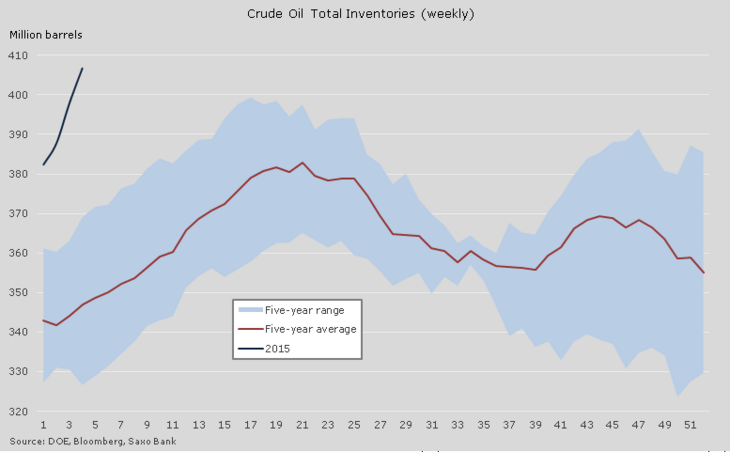

WTI crude oil touched a new six-year low after another strong rise in inventories. Stores reached 406.7 million barrels, the highest level since record-keeping began in 1982. The break below $44, however, failed to attract any follow-through selling and this was taken as a further sign that the playing field is no longer controlled by those looking for lower prices.

Brent crude oil, the global benchmark, was on track to record its best weekly performance since November and this resulted in the premium over WTI crude rising back above $4 per barrel. The spread between spot and the next futures month (currently April) also eased back below $1 after reaching $1.4 earlier this month.

This, again, is a sign that crude oil is finding a home – not least among those playing the contango trade.

Storage plays removing some Barrels

Inventory levels at Cushing, the delivery hub for WTI crude oil futures, has risen by more than 8 million barrels during the past four weeks while the amount of crude now in floating storage is expected to have exceeded 50 million barrels.

Other major onshore storage sites are swelling as well, with the 45-million barrel capacity Saldanha Bay in South Africa estimated by Citibank to have reached 85% of capacity. This is a clear indication that the storage play – where traders take advantage of the positive impact of buying cheap spot crude for sale at higher price in the future – remains very active.

Cut in investments a rising concern for the future

Some of the major global oil companies such as ConocoPhilips, Royal Dutch Shell, BP and Total continue to announce cuts to their investment programmes in response to the deteriorating outlook for the oil price. This led to a warning from Abdallah El-Badri, Opec's secretary general, that oil could spike to $200 in the future from the lack of investments made to develop new oil fields.

Such comments and actions may also have swayed some investors that now is a good time to get back into the market.

Survey pointing towards further losses before mild recovery late in the year

A fresh survey carried out by Reuters have found that 33 economists and analysts forecast Brent crude oil will average $58.3 in 2015 while WTI crude will average $54.2. If realised it will be the lowest annual average since 2005 – even less than during the global financial crisis in 2009 when Brent and WTI managed an average close to $62.5.

Gold and silver going into reverse but finding support

Gold and silver both remain at the top of the performance table this month despite the setback witnessed during the past week. The price of both went lower as event risks faded following the ECB meeting and Greek election.

Adding to the weakness was the hawkish statement following the latest FOMC meeting, which labelled the current bout of US expansion as solid, leaving the door wide open for a change in monetary policy later this year.

Although Greece remains a headache, the focus on event risks has faded thereby reducing gold's appeal as a safe haven. This reduced focus on Europe has primarily hit XAUEUR, which up until last week had showed some solid gains during January.

A concern for the bulls is the fact that we have seen a rapid increase in investor buying following the Swiss National Bank's shock decision on January 15 to remove the peg to the euro. This decision triggered a rush to secure government bonds with several seeing yields moving into negative territory, thereby removing the opportunity cost of holding gold.

Holdings in exchange-traded products backed by physical gold have jumped by 68 tonnes since that day and any significant pull-back from current levels would leave many, including hedge funds long through futures, out of pocket.

Almost all of this gold has been bought at prices higher than USD 1,252/oz. which is now a key technical area of support and a break below would signal some additional weakness, potentially towards USD 1221 /oz.

Author:

Ole Hansen, Head of Commodity Strategy, Saxo Bank. Ole Sloth Hansen is a specialist in all traded Futures, with over 20 years’ experience both on the buy and sell side. Hansen joined Saxo Bank in 2008 and is today Head of Commodity Strategy focusing on a diversified range of products from fixed income to commodities. He previously worked for 15 years in London, most recently for a multi-asset Futures and Forex Hedge fund, where he was in charge of the trade execution team. He is available for comments on most commodities, especially energies and precious metals.