As of summer 2025, the global economy is under immense strain. While many countries strive to recover from the economic and social aftermath of the COVID-19 pandemic, geopolitical conflicts, structural weaknesses, and new waves of protectionism act as significant brakes. At the center of attention are the political and economic shifts in the U.S., Germany's structural challenges, and fiscal reorientation strategies within the euro area. This analysis is based on the latest Creditreform Economic Briefs published on July 23, 2025, along with related statistical data and forecasts.

German Labor Market: A Gradual Slowdown

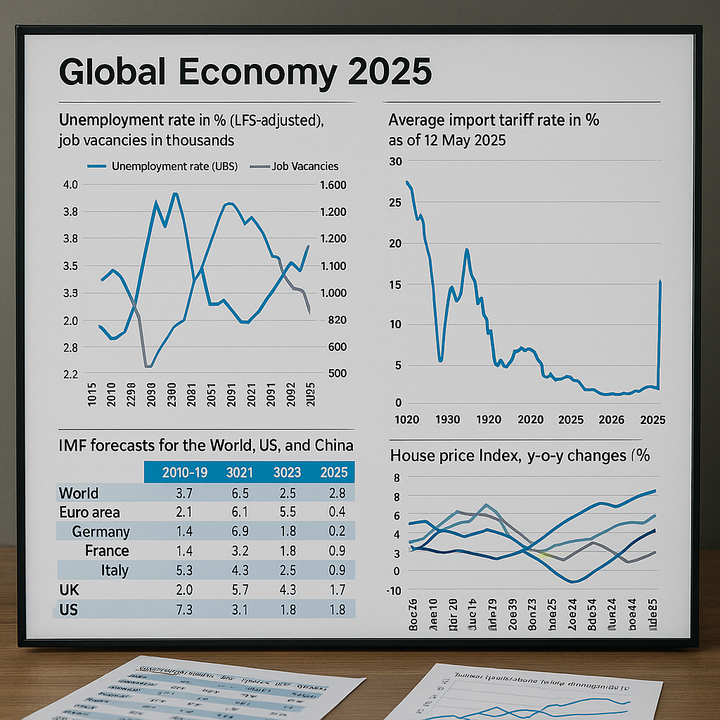

Germany's labor market has long served as an anchor of stability – yet cracks are now emerging. The unemployment rate has risen from a historic low of around 3.0% in 2022 to 3.7% in May 2025. Simultaneously, the number of reported job openings has declined sharply since its 2022 peak. This development signals not only cyclical weakness but also structural constraints such as skills shortages, sluggish digital transformation, and weak investment activity.

![Figure 1: Unemployment rate and reported vacancies in Germany (2019–2025) [Source: Eurostat, Creditreform Rating] Figure 1: Unemployment rate and reported vacancies in Germany (2019–2025) [Source: Eurostat, Creditreform Rating]](/fileadmin/user_upload/News/2025/Abb-01_Arbeitsmarkt_Germany_20250723.png) Figure 01: Unemployment rate and reported vacancies in Germany (2019–2025) [Source: Eurostat, Creditreform Rating]

Figure 01: Unemployment rate and reported vacancies in Germany (2019–2025) [Source: Eurostat, Creditreform Rating]

Despite this, there are no signs of a wave of layoffs. Germany’s short-time work scheme remains effective in preserving jobs, and a stable services sector helps cushion industrial setbacks. Wage trends are mixed: nominal wages are rising moderately, but inflation-adjusted income remains near pre-crisis levels. However, recent wage agreements in early 2025 may yield real income gains as inflation abates.

Trump Tariffs: A Trade War of Historic Proportions

With the introduction of so-called "reciprocal tariffs" by the Trump administration, the global trade order has been dramatically altered. U.S. import tariffs now average nearly 15% – the highest since the 1930s. European car exports face 25% tariffs, alongside electronics from East Asia and food products from Latin America. Many companies are now forced to restructure supply chains or relocate production to the U.S.

![Figure 2: Average U.S. import tariff rate since 1900 [Source: Yale Budget Lab, Creditreform Rating] Figure 2: Average U.S. import tariff rate since 1900 [Source: Yale Budget Lab, Creditreform Rating]](/fileadmin/user_upload/News/2025/Abb-02_Einfuhrz%C3%B6lle_USA_20250723.png) Figure 02: Average U.S. import tariff rate since 1900 [Source: Yale Budget Lab, Creditreform Rating]

Figure 02: Average U.S. import tariff rate since 1900 [Source: Yale Budget Lab, Creditreform Rating]

The economic damage is substantial. Inflation is rising due to more expensive imports, and global division of labor is deteriorating, reducing productivity. Germany is particularly affected – over 16% of its exports go to the U.S., mostly from its automotive and machinery sectors.

Economic Outlook: Germany Trails Europe

According to the IMF, Germany’s GDP will grow by only 0.1% in 2025 – far below the eurozone average (1.0%) and also lagging Italy (0.6%), France (0.5%), and Spain (2.4%). A modest rebound to 1.2% is expected for 2026, provided that investment plans materialize.

![Figure 03: IMF GDP growth projections for selected countries (2025e/2026e) [Source: Creditreform Rating, IMF] Figure 03: IMF GDP growth projections for selected countries (2025e/2026e) [Source: Creditreform Rating, IMF]](/fileadmin/_processed_/d/2/csm_Abb-03_Forecast_20250723_c1fcb2186f.png) Figure 03: IMF GDP growth projections for selected countries (2025e/2026e) [Source: Creditreform Rating, IMF]

Figure 03: IMF GDP growth projections for selected countries (2025e/2026e) [Source: Creditreform Rating, IMF]

Global growth impulses remain weak. The U.S. faces elevated interest rates and trade tensions and is expected to slow to 1.8%. China is cooling due to mounting debt and demographic pressures, falling to 4.0%. As a result, domestic demand and public investment are becoming the primary sources of growth for Germany – replacing its traditional export engine.

Housing Market: Rebound Amid Housing Shortage

Following a steep price decline between 2022 and 2023, Germany’s housing market is showing signs of recovery. In Q1 2025, home prices rose 3.8% year-on-year – after a double-digit drop in the prior year. Stabilized borrowing costs, real income gains, and resilient urban demand are behind this trend reversal.

![Figure 04: Annual change in housing prices in Germany and Europe [Source: Eurostat, Creditreform Rating] Figure 04: Annual change in housing prices in Germany and Europe [Source: Eurostat, Creditreform Rating]](/fileadmin/user_upload/News/2025/Abb-04_Hauspreise_Germany_20250723.png) Figure 04: Annual change in housing prices in Germany and Europe [Source: Eurostat, Creditreform Rating]

Figure 04: Annual change in housing prices in Germany and Europe [Source: Eurostat, Creditreform Rating]

Yet supply remains constrained. Housing permits have fallen to their lowest since 2010, and just 252,000 units were completed in 2024 – far short of demand driven by migration and demographic change. The Merz government aims to counter this with construction subsidies, faster approvals, and land reform.

Industrial Weakness: A Structural Crisis?

Germany’s industrial production index fell to 91 in May 2025 – the lowest since 2018. This decline is not merely cyclical but indicative of eroding competitiveness. High energy costs, bureaucratic hurdles, labor shortages, and the offshoring of research-intensive industries are major contributors. Energy-intensive sectors like chemicals, metallurgy, and machinery are hit hardest.

![Figure 05: Production index for industry and construction in Germany (2021=100) [Source: Destatis, Creditreform Rating] Figure 05: Production index for industry and construction in Germany (2021=100) [Source: Destatis, Creditreform Rating]](/fileadmin/user_upload/News/2025/Abb-05_Industrieproduktion_Germnay_20250723.png) Figure 05: Production index for industry and construction in Germany (2021=100) [Source: Destatis, Creditreform Rating]

Figure 05: Production index for industry and construction in Germany (2021=100) [Source: Destatis, Creditreform Rating]

There is one positive signal: business expectations (ifo index) have been rising since spring 2025. Whether this marks a turning point or a short-lived uptick remains unclear. Much depends on whether government stimulus measures translate into real economic activity.

Wages and Prices: The Return of Purchasing Power

Nominal wages in Germany have risen steadily since 2022, currently averaging 3.5% annually. Meanwhile, inflation has cooled significantly, reaching 2.0% in June 2025 – well within the ECB’s target. As a result, real incomes are growing again.

![Figure 06: Real, nominal wages and inflation in Germany [Source: Destatis, Creditreform Rating] Figure 06: Real, nominal wages and inflation in Germany [Source: Destatis, Creditreform Rating]](/fileadmin/user_upload/News/2025/Abb-06_Lohnwachstum_Germany_20250723.png) Figure 06: Real, nominal wages and inflation in Germany [Source: Destatis, Creditreform Rating]

Figure 06: Real, nominal wages and inflation in Germany [Source: Destatis, Creditreform Rating]

This may stabilize consumption, especially among middle- and lower-income households. Yet risks remain – rising rents and taxes could erode these gains. The federal government has introduced initial relief, including lower electricity levies and targeted tax cuts.

Conclusion: Domestic Hope, External Risk

Germany and the broader eurozone stand at a crossroads in 2025. Fiscal stimulus, rising real wages, and a stabilizing housing market offer a foundation for cautious optimism. Yet external shocks – U.S. tariffs, geopolitical tensions – pose real threats to this fragile recovery. The Merz administration is betting on expansive, investment-driven policy – but success depends on swift implementation and deep reform.

Whether this strategy succeeds will not be judged solely by GDP figures – but by the resilience of an economic model forced to reinvent itself.