The question that many investors are wondering is whether Donald Trump’s victory constitutes a real breach from the point of view of financial markets. Until now, the answer is NO. No one is able to know the exact measures that the President-elect will implement once he will be in office; not even him. However, in order to achieve its ambitious Keynesian-inspired recovery program (500 billion US targeting infrastructures), he will have to issue more public debt to finance it. In these circumstances, Donald Trump will certainly have to break his promise to raise tariffs against China because the country, who is the main holder of US treasury bonds (1157 billion US held last September), could decide to reduce its purchases in case of hostile trade measures from the US government. The United States’ high level of public debt makes the country extremely dependent on the goodwill of foreign investors. Therefore, the implementation of protectionist measures at an extended level is impossible. The most credible scenario consists in the increase in tariffs for certain targeted products, which could satisfy Donald Trump’s electoral base and has the advantage of avoiding a trade war with Asia. The renegotiation of trade treaties, such as the NAFTA, could also be an option, but the United States would take the risk to open the Pandora’s box because they are not the only ones with trade claims, Mexico and Canada as well.

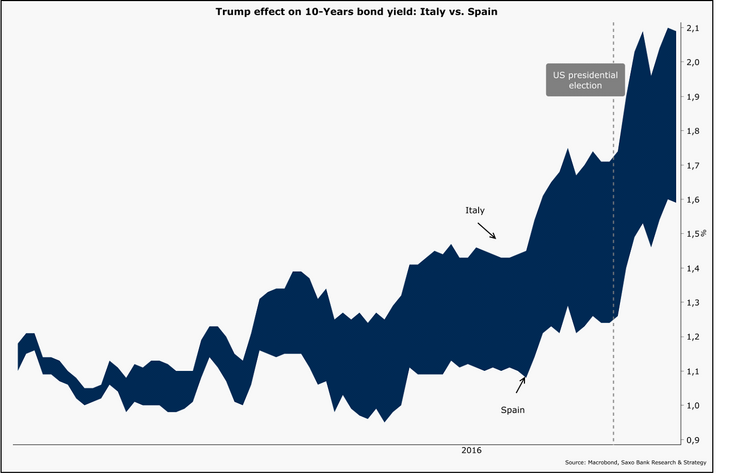

The Trump effect on financial markets has quickly vanished as expected. Interestingly, it seems that Italy and Spain are more vulnerable to populism than any other Western European countries. In the aftermath of Trump’s victory, Italy’s 10-Year bond yield has increased by 35 basis points and Spain’s 10-Year bond yield by 27 basis points, before declining slightly thereafter. This is a serious warning for these two countries as political risk remains very high in Europe in the coming months, due to the Italian referendum, the Austrian presidential election, which will also take place on December 4th, and the general election in Netherlands in March 2017 which could lead to a surge of the PVV of Geert Wilders.

Trump effect on 10-Years bond yield: Italy vs. Spain

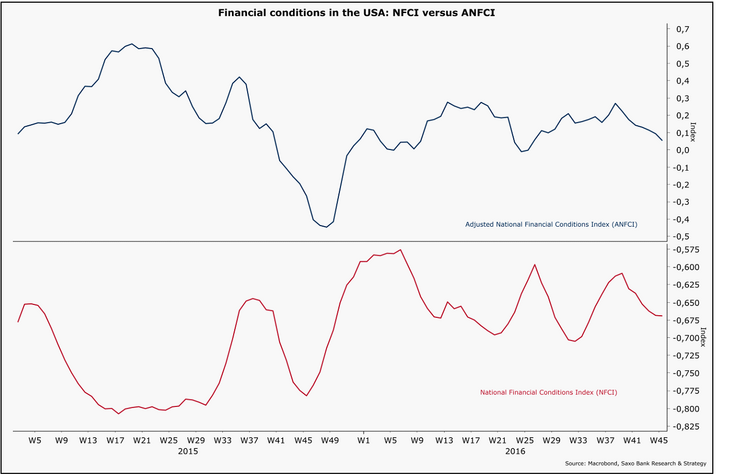

Regarding the financial conditions, they have not changed fundamentally in the United States since November 9th. The NFCI (National Financial Conditions Index) and the ANFCI (Adjusted National Financial Conditions Index), which is usually considered as more reliable, are still below the levels of December 2015 when the Fed raised rates by 25 basis points.

Financial conditions in the USA: NFCI versus ANFCI

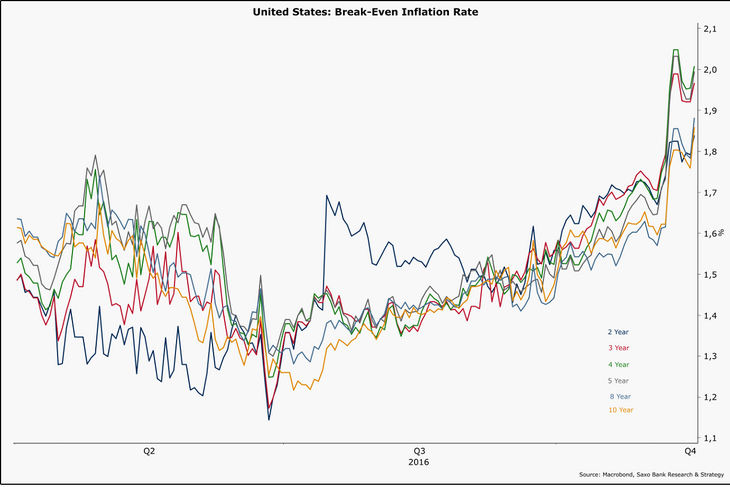

The real Trump effect, beyond the superficial and temporary appreciation of global stock market indices, is that it has boosted investor inflation expectations. The market bets that Donald Trump’s expansionary fiscal policy, trade protectionism and labor immigration restrictions will substantially push inflation up during his term. As a consequence, the break-even inflation rate for the United States has increased significantly in recent weeks to reach 1.97% at 3 years and 2% at 5 years. The five-year inflation forwards confirm this trend since they have increased from 2.14% at the beginning of November to 2.46% currently.

United States: Break-Even Inflation Rate

One could argue that the Trump effect on inflation is likely to fall flat. However, one should not forget that the underlying trend that explains most of the increase in inflation expectations is, actually, linked to higher global commodity prices (+0.58% in October 2016 compared to October 2015) and the slow exit of China from deflation (PPI to +1.2% in October y/y).

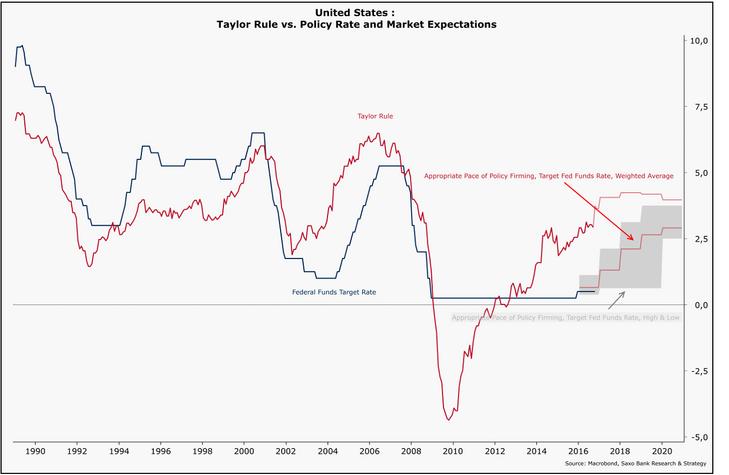

United States: The course is set for the Fed

Donald Trump’s victory is not really a game-changer for the US monetary policy. The Fed has a window of opportunity until February 2018, which corresponds to the end of Janet Yellen’s mandate, to continue to hike interest rates. Replacing her before this deadline has zero chance of happening. The US president can invoke only two legal clauses to replace a member of the FOMC. The first one consists in invoking "serious misconduct". However, although this legal term remains subject to interpretation, there is nothing to suggest that Janet Yellen committed such a crime. The second lever that Donald Trump could use is to keep Yellen as Chair of the Board of Governors but to reduce its room for maneuver. To do so, the statutes of the central bank must be amended, which requires a simple majority in the Congress and the presidential approval. Nevertheless, it is quite unlikely that such a decision will obtain the support of the Republican Party.

Therefore, the process of normalization of the US monetary policy will probably not be influenced by the political change in Washington. The increase in rates in December (which could reach a maximum of 25 basis points) could be a non-event because it has already been priced in in the market, especially in the Dollar Index which has risen by around 4% since November. All data (including Taylor rule and investor expectations) confirm that the Fed will hike rates at its next meeting. The Taylor rule (which has been a very useful tool for the Fed since early 1990s) indicates that the weighted average interest rate should be slightly above 2% at the end of Janet Yellen’s term.

United States: Tylor Rule vs. Policy Rate and Market Expectations

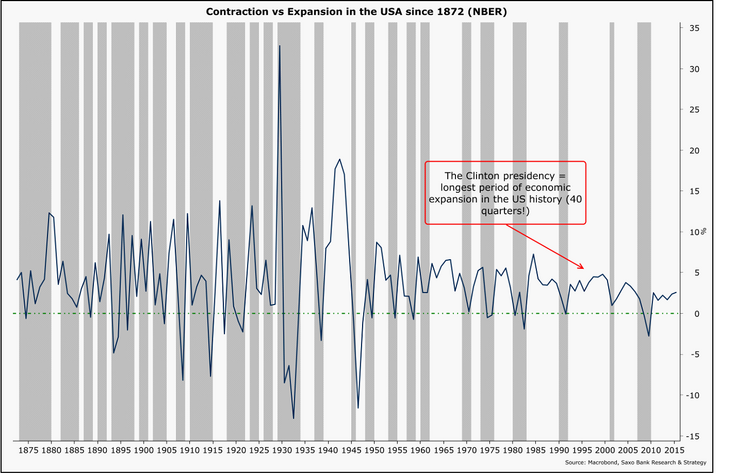

However, this theoritical level remains insufficient to cope with the inevitable economic slowdown in the United States. The latest indicators confirm the economy is healthy but it is approaching the end of the business cycle. Retail sales are up the most in the past two years but department store sales continue to fall. In addition, the Empire State Manufacturing has rebounded strongly but employment indicators are more negative and optimism is declining. Since the last economic downturn, 35 quarters have passed. Except a new record of longevity (40 quarters during Clinton’s golden age), the United States will face a new recession during Trump presidency. The president elect’s Keynesian economic program could be of a great help to stimulate the economy when it will be the most needed, especially if the Fed does not have enough room to lower interest rate and reassure investors.

Contracton vs Expansion in the USA since 1872 (NBER)

Western Europe: The Italian nightmare

In the near future, the real problem for investors is not about the fear of recession in the United States but rather about the return of political risk in Italy. The first week of December is highly risky for the country and for Europe. Indeed, two events likely to increase volatility in the market will occur at the same time: the Constitutional referendum of December 4th and Monte Paschi’s tricky recapitalization which could revive concerns about the European banking sector if it does not succeed.

As the latest poll conducted before the referendum indicates, the games are far from done. The "NO" vote is leading with 42% of voting intentions versus 37% for the "YES" vote. However, as it was the case with the UK referendum, Italian’s undecided voters (21% of voting intentions) are the key to the vote. In mid-November, Prime Minister Renzi received the unexpected support of Brussels.

Indeed, Italy, which is not expected to meet its deficit targets for this year and for 2017, is likely to be the main beneficiary of the EC’s change of heart regarding fiscal stimulus. However, it may not be enough for the Democratic Party to win the referendum due to rising populism and anti- establishment sentiment all over Europe, especially in Italy.

In case that Prime Minister Renzi is forced to resign and the recapitalization of Monte Paschi goes wrong, we expect spreads for Italy to rise by several tens of basis point and Italy’s rating to be placed on negative outlook (currently stands at BBB- with stable outlook by S&P).

However, the risk of significant contagion to other European countries is quite limited for three main reasons:

- The amount of non-performing loans in the Italian banking sector is about 400 billion euros but has stabilized in recent months, which is rather a positive sign. Of this total, only 10% represents an immediate real risk. Moreover, a significant part of NPLs is linked to the very bad habit of the Italian public sector to systematically delay payments to suppliers;

- In case of European contagion from Italy’s political and bank meltdown, the ECB still have ammunition left to intervene. The central bank can either decide to launch a targeted TLTRO operation to help the Italian financial sector or active the OMT program in the worst case scenario;

- In the past few years, the main reason explaining reluctance to buy European banking stocks has been linked to low interest rates. Now that sovereign bond yields are rising because of higher inflation expectations, investors get a good reason to buy bank stocks. This new narrative certainly makes them more resilient to Italian risks than a few months ago.

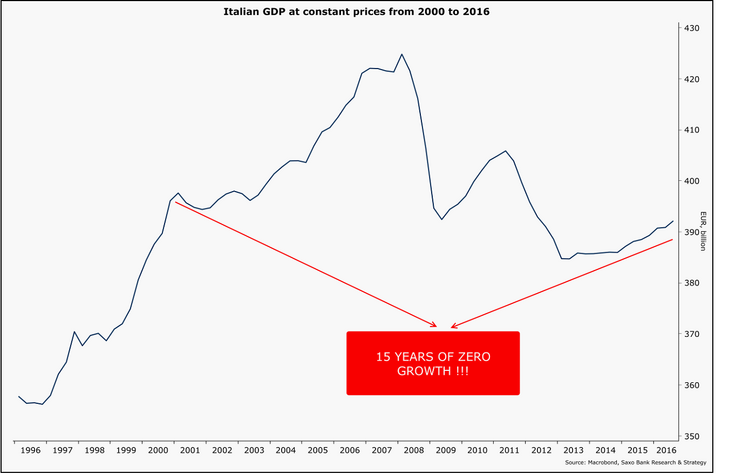

In fact, the problem of the Italian banks is only the tree that hides the forest. Indeed, Italy has practically vegetated for more than twenty years. Despite the popular support that Prime Minister Renzi enjoyed when he took office, he failed to reverse the economic downward trend, which fueled populism. A single figure shows the extent of Italy’s tragic economic failure: at constant price, the country’s GDP has not increased by one iota in the last fifteen years. 15 years of zero growth! The issues of the banking sector will be solved, no doubt about it, but they will resurface sooner or later if the country fails to achieve higher growth.

Italian GDP at constant prices from 2000 to 2016

APAC: Japan’s failed bet

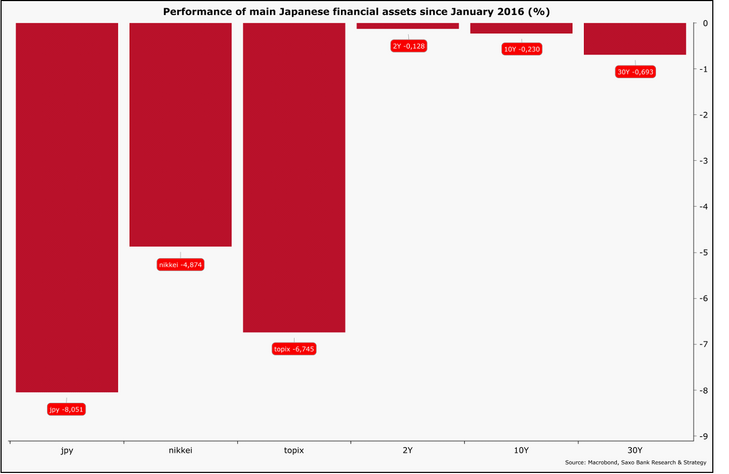

The other loser of this year, far ahead of Italy, is Japan. Japan’s inventiveness in the field of monetary policy and the government’s new stimulus plan unveiled last August will not (once again) have borne fruit. Since the beginning of the year, the main Japanese assets evolve in the red: USDJPY -9%, Nikkei -6%, Topix -8%, 2-Year bond yield -0,1%, 10-Year bond yield -0.2% et 30-Year bond yield -0.7%. This is the proof that investors do not believe in Japan’s ability to exit permanently from deflation.

Performance of main Japanese financial assets since January 2016 (%)

Moreover, the fact that the central bank has postponed to reach its inflation target after April 2018, which corresponds to the end of the mandate of Haruhiko Kuroda, is a confession of failure. Inflation is here, but it is not self-sustaining because it does not affect the whole economy. Mostly large companies have contributed to the rise in wages in recent years (average increase of 2.14% this year versus 2.38% a year earlier; the current slowdown is mainly due to higher JPY which has weighted on profits). Small and medium-sized companies did not play the game because they were prevented from doing so. Large companies have agreed to raise wages but have sought to restore their margins by forcing their suppliers to keep prices very low, thus preventing any significant rise in wages at their level. The problem of Japan is not economic, it is political. Prime Minister Abe must take advantage of having the full support of his party in order to force the keiretsu to tap into their large reserves of cash to reduce the pressure on SMEs and invest. This is certainly one of the few options left to put inflation on the right track.

CEE: Poland’s misstep

In this year end, Japan and Italy are not the only countries in a bad position. Long regarded as a model of economic development, Poland has made a mistake that could cost him dearly. The decision to lower retirement age from 67 to 65 for men and 60 for women is a popular measure but, under current conditions, it is not budgeted and will inevitably lead to an increase in taxation. This could, in turn, weaken consumer spending which is the main driver of growth while the construction sector has been experiencing a massive deceleration for several months and the investment is unusually low due to the slow integration of European funds.

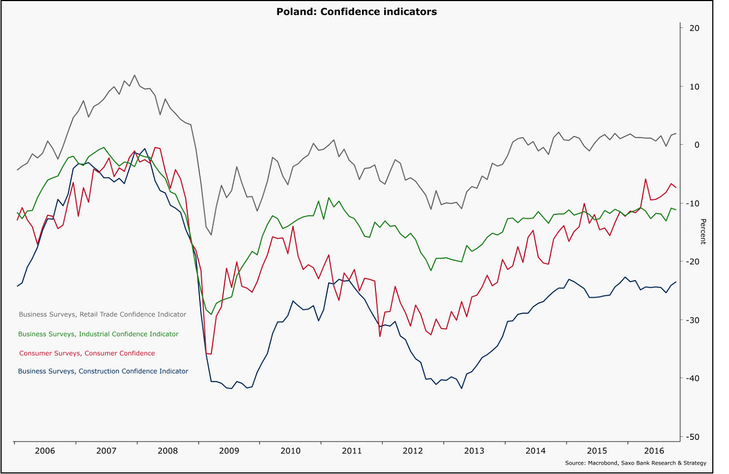

Poland, like most of CEE countries going through slower GDP growth, considers this phase to be transitory. Nothing is less certain. Indeed, all the indicators of economic confidence (except for consumer confidence) are stagnant or even slightly declining, such as industrial confidence.

Poland: Confidence indicators

The economy is in the midst of a deceleration and it is likely that government’s growth target of 3.4% this year (compared to a previous estimate of 3.8%) is a wishful thinking. GDP growth around 3% this year seems much more credible. Under these conditions, the expected interest rate hike by the Polish central bank won’t happen anytime soon. If the current slowdown continues, as it is possible, Governor Glapinski may even be forced to think about lowering interest rates in 2017.

MENA: Egypt learned the hard way

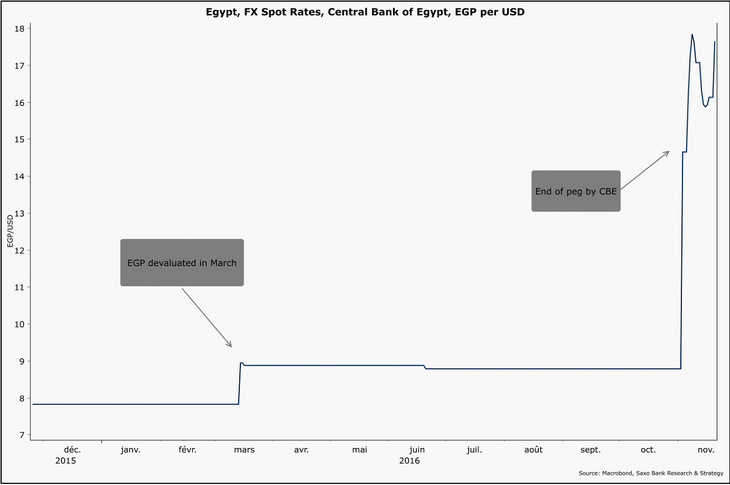

Finally, in MENA, there is one country that is doing quite well in this year end and seems to draw lessons from the past: Egypt. The country decided to abandon the currency peg to the USD in early November, leading to a depreciation of about 100% of the Egyptian pound in the official market.

Egypt, FX Spot Rates, Central Bank of Egypt, EGP per USD

It was a condition required by the IMF to secure a 12 billion USD credit line from the international organization. In the short term, it means higher inflation (given that it has already increased in the wake of the devaluation that occurred in March) and a higher risk of social unrest. However, this is a lesser evil. The country had no other option on the table. The economic cost of the peg was enormous since it implied to keep a restrictive monetary policy that curbed aggregate demand. The floating of the Egyptian currency will make possible to restart the domestic demand in the medium term and to develop the economy on the condition that the government also implement reforms by reducing trade barriers and privatizing public companies which are neither efficient nor productive in the current system. Egypt seems to have understood the basic rule of economics: a country with weak political institutions and a weak economy must have a weak currency. The central bank must avoid intervening in the foreign market to push up the pound. Its top priority must be, from now, to maintain a stable exchange rate, around 17 pounds per US dollar.

Author:

Christopher Dembik, Head of Macro Analysis bei der Saxo Bank