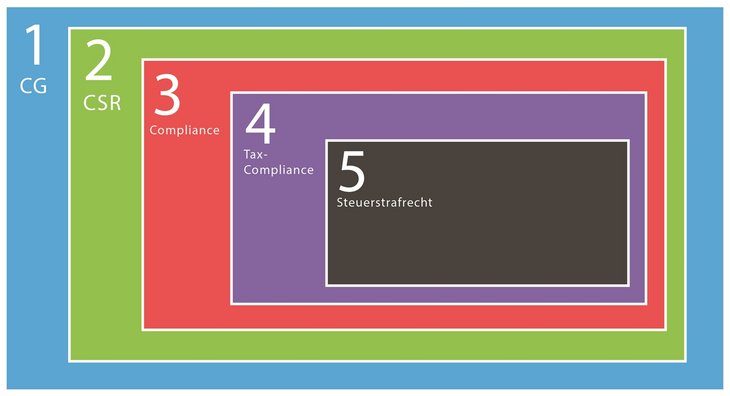

The relationships between corporate governance (hereinafter "CG"), corporate social responsibility (hereinafter "CSR"), compliance, tax compliance and the fiscal offence law have not yet been discussed intensively. However, through the German Corporate Governance Code (hereinafter referred to as “DCGK"), the CSR Reporting Guidelines and the corresponding German Implementation Act, this issue has become more important. The following diagram is a simplified representation of the relationships between CG, CSR, compliance, tax compliance and the fiscal offence law.

If an entrepreneur, employee, or institute intentionally violates applicable tax regulations, they commit tax evasion in accordance with Section 370 of the German Fiscal Code. In this circumstance (see section 5 of the diagram) there is also a violation of tax compliance, compliance, CSR and CG.

However, not every violation of tax compliance leads to fiscal offence accusations. If there is a violation of tax compliance, there is also a violation of compliance, CSR and CG (see Section 4 of the diagram).

However, not every violation of tax compliance leads to fiscal offence accusations. If there is a violation of tax compliance, there is also a violation of compliance, CSR and CG (see Section 4 of the diagram).

A violation of compliance regulations does not always include a breach of tax compliance or the perpetration of a fiscal offense, since the area of compliance includes other compliance complexities, such as IT compliance (see Section 3 of the diagram). However, a violation of compliance regulations also results in a violation of CSR and CG, since adherence to compliance regulations is the minimum of CSR.

A violation of CSR does not automatically mean a violation of compliance or tax compliance, let alone perpetration of a fiscal offense. Compliance includes the obligation to adhere to applicable law. However, if a company has committed itself, for example through internal guidelines, to avoid tax avoidance strategies that violate CSR, this area is not only covered by CSR, but also by compliance and tax compliance. As long as these tax avoidance strategies are to be brought into line with the applicable tax law, however, this does not include the fulfilment of a condition according to Section 370 of the German Fiscal Code. A violation of CSR regulations also includes a violation of CG regulations (see Section 2 of the diagram).

If a company violates CG regulations, this does not automatically constitute a violation of CSR, compliance or tax compliance regulations, let alone substantiate the allegation of tax evasion, since CG also includes, for example, compliance with technical regulations to which the areas of CSR, compliance, tax compliance and fiscal offence law do not necessarily refer. However, to avoid liability cases, it would make sense for a company to adopt all CG regulations. A company that complies with all CG regulations accordingly complies with the CSR, compliance and tax compliance regulations and commits no tax offences through its corporate bodies.

Author:

Dr. Andreas Grötsch, Lawyer / Tax Advisor, Finance Lawyer for Fiscal Law, Finance Advisor for international Fiscal Law, Lecturer at the THD