Attacks in 2015 have led to a renewed focus by world powers on combating terrorism. Of greatest concern is the Islamic State, which remains powerful in Iraq and Syria and is expanding its presence throughout the Middle East and North Africa. The "war on terror," which began in earnest after the September 11, 2001, attacks in the United States, is likely to continue for at least another decade, according to BMI Research (BMI), a part of Fitch Group, a global leader in financial information services. "The United States and Russia have learned lessons in the past about the difficulty of fighting ground wars for extended periods of time in the Middle East and Afghanistan, and neither country appears willing to risk repeating those earlier experiences," said Yoel Sano, BMI’s head of Global Political and Security Risk. "That means the most likely response from these and other governments will be an air campaign, which may not be enough to defeat the Islamic State."

In addition to their role in prolonging instability in the Middle East, the risk of terrorist attacks will persist in North American, European, and Asian countries, even as they introduce stronger security measures. The threat of terrorism has also increased concerns in Western countries about immigration policy, and has proven to be a boon for right-wing political parties in Europe.

Emerginig economies struggle

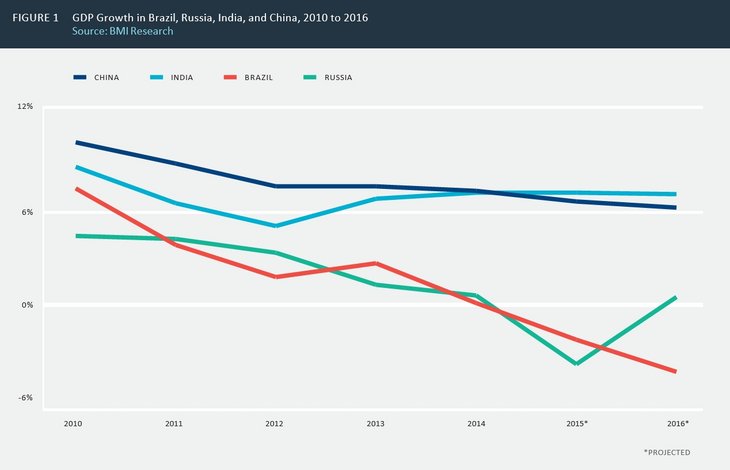

China continues to struggle as the country’s economy shifts its focus from investment to consumption. In the third quarter of 2015, real GDP growth in China fell to 6.9% year over year, the slowest growth since the first quarter of 2009. Economic reforms, a weak real estate market, over-leveraging of corporate entities, and rising wages – which will eliminate a significant competitive advantage for Chinese manufacturers – will likely continue to limit growth in the next several years. In 2016, BMI forecasts real GDP growth of 6.3% (see Figure 1).

China’s slowdown is emblematic of the broader struggles of emerging markets globally. In Brazil, fixed investment and household consumption remain weak, driven by rising job losses, high inflation and interest rates, and a prolonged investigation into alleged corruption at Petrobras; BMI forecasts GDP contraction of 4.4% in 2016.

Meanwhile, investment growth in Russia has been minimal since 2012, and the deep recession in 2015 only exacerbated the problem for the Russian economy. Consumption will likely recover slowly in 2016, but inflation will stay high and nominal wage growth will remain subdued. BMI forecasts real GDP growth of 0.5% in 2016.

A bright spot among emerging economies is India, for which BMI forecasts real GDP growth of 7.2% in 2016. Prime Minister Narendra Modi’s business-friendly government has launched several initiatives designed to boost economic investment, including by foreign entities, and to stabilize the Indian rupee. Industrial production is also expected to increase as many companies have announced plans to build factories in India in 2016.

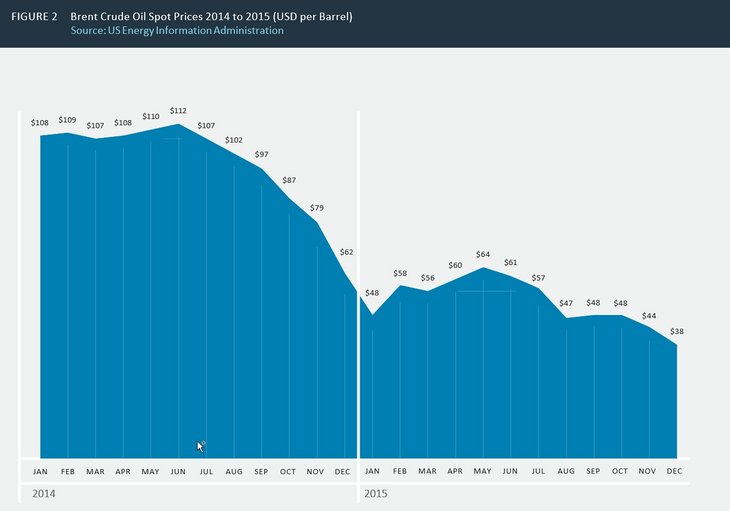

Falling commodity prices

Oil prices dropped precipitously in the second half of 2014. Although prices rebounded somewhat in the first half of 2015, they have since fallen even lower. From a recent high of USD 112 per barrel in June 2014, prices for Brent crude oil fell to USD 38 per barrel in December 2015, the lowest price since July 2004, according to the US Energy Information Administration (see Figure 2). BMI forecasts an average price for Brent crude oil of USD 42.50 per barrel in 2016, which will continue to have negative effects on the economies of oil-exporting countries, adding to their political risks. Those

at highest risk include Angola, Congo-Brazzaville, Equatorial Guinea, Iran, Iraq, Nigeria, and Venezuela. Low oil prices could also increase political risk in Russia.

"Many net oil exporters already faced significant political risks before the drop in oil prices, which could be exacerbated if prices remain low," Yoel Sano said. "In Venezuela, for example, voter dissatisfaction with the poor economy and high inflation contributed to the opposition party’s victory in December’s legislative elections. That could lead to a move away from the statist system in the long run, but the near-term impact is greater political risk stemming from internal political clashes. Low oil prices and economic sanctions could keep the Russian economy weak, although political change is unlikely as President Putin remains a popular figure."

Beyond oil, prices for a number of other agricultural commodities, livestock, and precious and industrial metals have fallen since early 2014. For example:

- Prices for cotton, which had sold for more than USD 90 per pound in March 2014, fell to below USD 65 per pound in December 2015.

- Gold, which had sold for more than USD 1,300 per ounce in June 2014, fell to below USD 1,100 per ounce in December 2015.

- Copper prices fell from more than USD 3.20 per pound in June 2014 to just over USD 2 per pound in December 2015.

The global decline in many commodity prices has been attributed in part to the economic slowdown in China, which no longer has the same voracious appetite for materials imported from Latin America, Africa, and elsewhere. Coupled with rising interest rates and the slump of currencies against the US dollar, these falling prices portend an increase in political risk in many emerging markets whose economies rely on commodities exports, such as Brazil. The drop in prices could also have lasting economic effects on resource-rich developed economies, including Canada and Australia.

Rivalries among "great powers"

In 2016, we will likely see continuing tensions among the world’s three "great powers" – the United States, Russia, and China – and between these countries and various regional powers. In 2016, tensions could continue to build between:

- China and Japan in the East China Sea, and China and the US in the South China Sea, stemming from China’s assertion of territorial rights and construction of artificial islands and airstrips.

- North Korea and South Korea, especially after the North’s announcement in early January of a successful nuclear bomb test. Should a conflict develop between the two countries, it could easily draw in the US, China, and Japan, all of which have strong interests in the security and stability of the Korean Peninsula.

- Russia and the North Atlantic Treaty Organization in the Baltic states or Eastern Mediterranean, as NATO extends membership invitations to more countries (the most recent being Montenegro).

- Russia and Turkey, exacerbated by the latter’s downing of a Russian military jet in November 2015 near Syria’s border with Turkey.

"Both China and Russia appear intent on flexing their muscles and playing a greater role in the politics of many regions, as evidenced by China’s plan to build a military base in Djibouti, in the Horn of Africa," Yoel Sano said. "We expect that rivalries between both the great powers and regional powers like Turkey will continue to develop, including some direct confrontations and proxy wars in the coming years."

Managing political risk

As we were reminded by recent events in Paris and elsewhere, terrorist and politically motivated attacks often occur without warning. And as falling oil prices and other factors continue to put pressure on several countries’ economies, it’s critical for businesses to be prepared for the possibility that political violence, unrest, or other large-scale crises will quickly develop in virtually any part of the world – including those countries that were historically seen as safe or stable.

Businesses can prepare for these risks in several ways:

- Manage credit risk. When a government collapses or descends into crisis, it often loses its ability to honor financial obligations. This can create a chain reaction of default that spreads into the private sector. Businesses should review their credit risks and credit-control policies and procedures, and evaluate the potential impact of political risk on the countries in which they, their customers, and suppliers operate.

- Build resilient supply chains. Before a crisis develops, an organization should understand how a crisis in one country can disrupt its global supply chain. Businesses should also have response plans in place to allow for the use of alternative suppliers and/or ports, and to communicate with customers and suppliers as needed.

- Protect people. Developing and testing crisis plans in advance can help ensure effective communication during and immediately following a crisis.

- Protect assets through insurance. Credit and political risk insurance can protect against a variety of risks, including expropriation, political violence, currency inconvertibility, non- payment, and contract frustration.

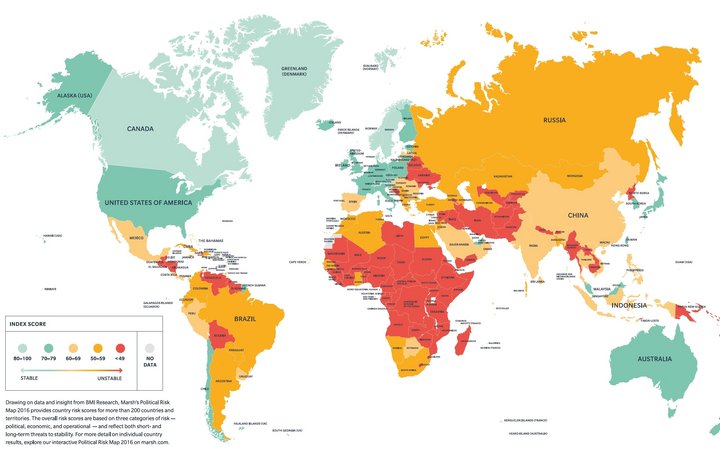

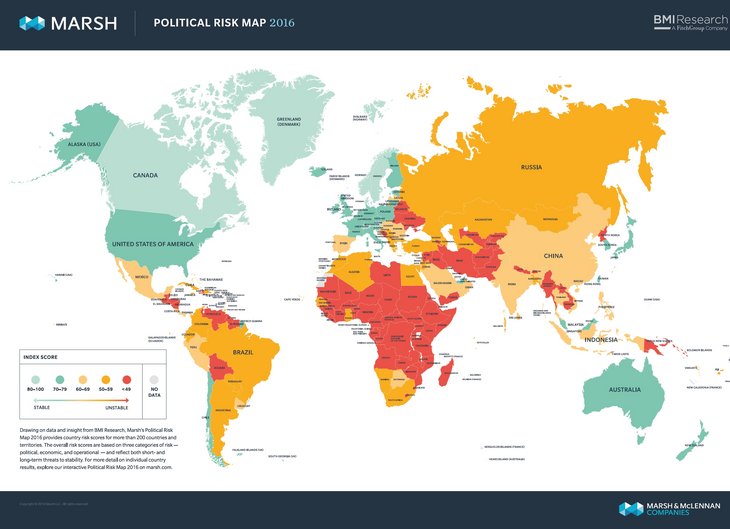

Political Risk Map 2016

Drawing on data and insight from BMI Research, Marsh’s Political Risk Map 2016 provides country risk scores for more than 200 countries and territories. The overall risk scores are based on three categories of risk – political, economic, and operational — and reflect both short- and long-term threats to stability.

[Source: Text based on Marsh’s Political Risk Map 2016]